The lira continued to weaken from the toxic combination of:

The rising US treasury yields and stronger USD

Turkey's diplomatic woes surrounding the US, and

The President Recep Tayyip Erdogan's renewed push for lower lending rates in the banking sector. In the latter context, Erdogan highlighted during a parliament speech recently that monetary conditions and access to loans have improved recently, despite resistance from the banks.

CBT held its MPC meeting today: The benchmark interest rate in Turkey was last recorded at 8 pct. Whereas the government is pushing ahead with measures to lower the lending rates of banks, in particular at state-owned banks - within this environment, a rate hike by CBT going forward seems exceedingly unlikely. The Central Bank of Turkey held its benchmark one-week repo rate at 8 pct.

On the contrary:

1) Core inflation has reached double-digit and shows no sign of calming down;

2) The trade deficit is widening out once again because of stronger import demand and higher oil prices;

3) The lira is weakening again - this is because higher inflation has lowered the real interest rate, while global bond yields are, in fact, rising.

At one point earlier this year, it appeared that the lira had stabilized; that core inflation might decelerate towards 9% - given that the weighted average cost of funding was around 12%, the prospective real interest rate had risen to a healthy c.3%. But, once core inflation is 11%, the real interest rate is back down at 1%.

We have experienced numerous times in recent years that this level does not support the lira when global yields are rising and EM risk appetite is reversing, which is the case now.

As a result, USDTRY has broken out to the topside recently; inaction on the part of CBT will only exacerbate this trend.

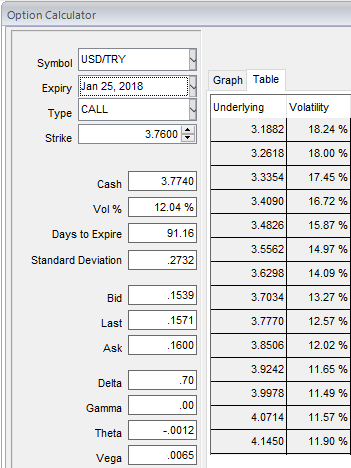

Yesterday, USDTRY traded up to 3.8080 on the onset of the news and retraced to 3.7210 currently. Buy the tail: Relative to recent history, implied vol and risk reversals are not high. Current 3m implied vol (12.5) could spike to the 16-20 area if accelerated depreciation did occur, while risk reversals could easily rise by 1-2 vol points.

Turkish lira implied volatility and risk reversals are among the highest in emerging markets. However, relative to recent history, they are not high in their own right.

Current 3m implied vol (12.04) could spike to the 15-16 area if accelerated depreciation did occur, while risk reversals could easily rise by 1-2 vol points.

This lends itself to owning volatility, and given the difficulty in ascertaining the probabilities of a “spike followed by a recovery” versus a “trend” move higher in USDTRY, we prefer a one-touch structure over a European digital. Hence, buying USDTRY 3m one-touch knock-in 4.25 has been advocated.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?