Kiwis Q3 growth spikes by a mightier-than-anticipated 1.1%. However, the upward bombshell was more than offset by downward revisions to growth in the first half of the year, meaning the annual growth of 3.5% was a touch below expectations. As expected, growth was broad-based across industries. Meanwhile, the current account deficit was unchanged at 2.9% of GDP.

On the flipside, the Brexit-related dangers for the UK economy beyond initial confidence are yet to develop, and the scale and scope of BoE’s easing would cap GBP.

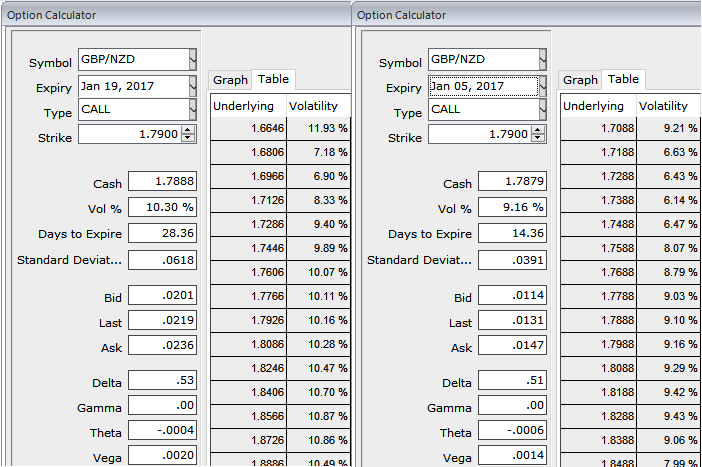

GBPNZD ATM IVs of this pair is trading shy above 9.15% for 2w and 10.3% for 1m tenors as the sideway trend likely to persist.

As the fundamental risks lingering on the both sides of currencies, we uphold our previous option strategy, which is the long put butterfly spread is advocated on speculative grounds that carries the limited returns and the limited risk. The strategy is taken when the options trader thinks that the underlying spot FX would not spike or drop much dramatically on expiration.

Three distinctive strikes are involved in this spread and it is constructed by buying one lower striking put, writing two at-the-money puts and buying another higher striking put for a net debit.

The execution: Buy (1%) 1m in the money put option, short 2 lots of 2w at the money put options, simultaneously; buy one more (1%) 1m out of the money put option.

The maximum return for the long put butterfly is achievable when the GBPNZD spot remains unchanged as stated in above range at expiration. At this price, only the highest striking put expires in the money.

The maximum loss for the strategy is limited to the extent of initial debit taken to enter the trade plus commissions.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms