As developments on the COVID-19 outbreak, and related spillovers, like Oil prices crash, have dominated market focus over the past two months, FX vols dynamics followed a high correlation with Equity (especially US) indices since the Outbreak of the COVID- 19 crisis, with a sharp rise from late February to mid-March and a sharp drop ever since. Earnings momentum to remain negative. IBES is cutting, but keeps having 2021 EPS projections above 2019. Such a fast EPS rebound didn’t tend to materialize historically. A large number of companies have already cancelled their dividends for the year. While Q1 S&P500 EPS continues to move lower, down from $40 at the start of the year to $32 currently.

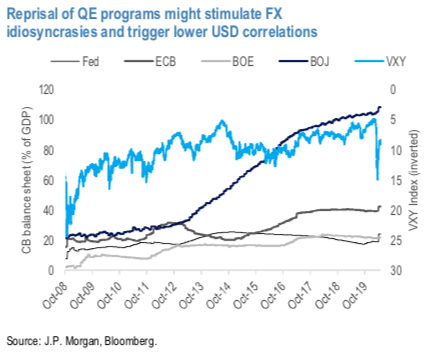

Room for idiosyncratic patterns was limited in scope, and linked to political rather than macro factors, as in the case of BRL vols rising sharply from mid-April. Increasing balance sheets by major central banks can be a factor leading to lower FX vols (Two macro factors suppressing FX volatilities, October 2019, refer above chart), although retracement from mid-March highs has already been substantial. Resumption of and relative divergences in QE programs could also stimulate de-correlation moving forward.

We overview select opportunities of elevated skew and correlation parameters that still price-in substantial premia, and would offer, better than vol levels, room for playing a gradual emergence from distressed markets mode and/or idiosyncrasies in the FX space.

We introduce a model for FX vol curves based on the correlation between spot and rates differentials. The analysis favors a RV long 6m6m USDZAR fwd / short 6m6m AUDUSD fwd vol, implemented via Gamma- neutral calendars. Courtesy: JPM

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes