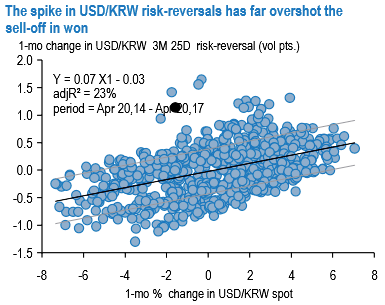

The explosion in KRW risk-reversals in response to geopolitical developments around North Korea has garnered a lot of attention. The 1.5 pt. the spike in 1Y 25D riskies is understandable when risks around a baseline non-military resolution to the current conflict are so acute, but is notable for the extent to which it has overshot the sell-off in won (refer above chart).

We found three other instances of similar spot skews disconnect in the post-GFC data, but unfortunately, the small sample size and the inconsistency of market developments in those episodes leave us with no reliable priors for how either USDKRW spot or riskies themselves might respond in the current instance.

Selling USDKRW vols and risk-reversals has historically been big winners since the crisis despite the odd bout of equity volatility, and geopolitical conflicts in the Korean peninsula, in particular, have been short-lived affairs in the past that rewarded sellers of risk premium. That may well turn out to be the correct template to follow once again, but we judge the downside from being catastrophically wrong too high to fade skews outright.

Valuation matters too in that despite their optical bounce, risk-reversals/ATM ratios around 30% are in fact below the post-2009 average, meaning it is more the case that skews were at multi-year depressed levels earlier in the year than overly expensive currently. In the absence of an open-and-shut valuation case and unpredictability of the geopolitics, any short skew trades need to be of the defined premium, bearish won variety.

Hence, we favor 1*2*1 USD call/KRW put butterflies with asymmetric strikes that can retain some positive P/L even in the tail event of an outsized USDKRW rally through the far strike. The above table lists a selection of USD call fly strikes that satisfy a set of (arbitrary) criteria on pricing and leverage optics and suggests 2M 1160-1200-1220strike selections offer a decent value.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms