EM FX looks like it has appreciated more than EUR recently which may give some headwind to the extent of EM moves, if the EUR does not recover further.

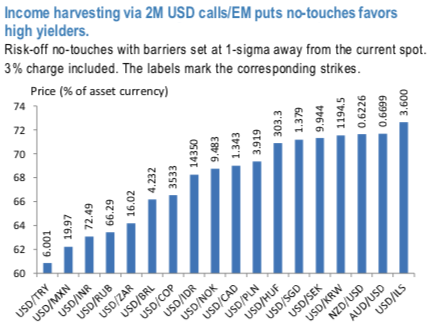

A passive play on a cautiously EM supportive sentiment is to own short-dated USD/EM call no-touches (NTs). These take advantage of elevated levels of spot, forward/NDF points, vols and skews and can be viewed as defined downside alternatives to selling naked vanilla EM puts. 1st chart ranks 2M high beta structures with barriers set to 1-sigma away from spot (arbitrary condition but sets pricing of different pairs on same footing). Vol selling is a poor leverage.

Likewise, 2nd chart shortlisted 2M structures offer 1:1.5 risk/reward ratio, with sensible barrier selection at 1-sigma away from current spot (here, 1-sigma = std.dev. of 2m spot returns over the past 12-months).

To avoid the year-end holiday effect on pricing consider in 3M expiry: 3M USDMXN call no-touch with barrier at 19.90, the level last seen 2m ago, costs 50.0/52.75%, indic, (spot reference: 19.19).

3M USDRUB call no-touch with barrier at 66.0, costs 51/56%, indic, spot reference: 63.80 levels. Courtesy: JPM

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?