The Brexit deadlock still remains intact, as the geopolitical dust seems to have been livened up again, the “Malthouse compromise” is making the rounds, a joint proposal by Brexit hardliners and more moderate Tory MPs. Is that the beginning of a last-minute breakthrough? The content is nothing but a repetition of the old idea of avoiding an Irish border with the help of a “technological solution”.

Thereby, exactly the same idea that had already been discarded in the negotiating process long ago. And it had not been discarded because the idea in itself was bad, it had failed because British politics are very good at talking but in the 2 1⁄2 years of the negotiating process have failed to make any efforts whatsoever to develop such a technological solution.

The FX market rewards the last-minute operational bustle with significant GBP strength (EURGBP below 0.87, GBPUSD above 1.30). What did it expect? That the British politicians would sit back and wait until time runs out on 29th March? It would seem that even small things are enough to make the GBP investors happy at present.

We would warn against using this as an opportunity for poorly diversified GBP-long bets. The likelihood of a no-deal scenario seems to have fallen a little again, but certainly not far enough for tactical plays in GBP. As GBP risk in case of a no deal can be expected to be very significant, marginal changes in no-deal probabilities should not change the strategic attitude towards GBP risk.

And in general, the market reaction illustrates that the market reacts much more to GBP positive news than to GBP negative ones. That suggests that in case of a no deal scenario the market reaction could be very pronounced as many would be caught on the wrong foot.

OTC Outlook and Hedging Strategy:

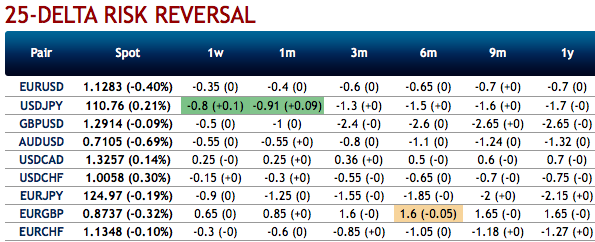

We risk reversals indicating major bearish hedging sentiments remain intact, negative bids are observed in the GBPUSD risk reversals across 1m -1y tenors. While positively skewed implied volatilities of 3m tenors also show hedging interests in bids for OTM puts that signal bearish risks.

We reckon that the sterling should not suffer like before, but, one should not disregard the major downtrend as well.

Both the speculators and hedgers of GBPUSD are advised to capitalize on the prevailing price rallies for bearish risks and bidding theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize delta longs.

Strategic Options Recommendations: On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way: Short 1m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in the short run and bearish risks in long run by delta longs. Courtesy: Sentrix, Saxo & Commerzbank

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards 74 levels (which is bullish), while hourly USD spot index was at -67 (bearish) while articulating (at 11:22 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data