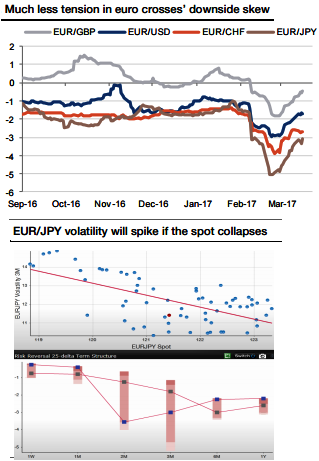

The FX euro vol market is complacent compared to the bond market, seeing the resilient 10y OAT-Bund spread. This relief offers an attractive entry point to hedge a large euro downside move via options. The 3m downside skew in euro crosses retraced sharply, and almost fell to last year levels in the EURUSD and EURGBP (see above graphs).

The EURJPY and EURCHF skew are also materially less expensive, with, in particular, the EURJPY 3m risk reversal returning below -3 from -5. Indeed, the 3m ATM vol is not that high compared to the spot level, further suggesting designing a long vega hedge.

The likely victory of a market-friendly candidate would redirect attention to ECB tightening, propelling the euro gradually higher.

On the contrary, a Le Pen victory would imply an immediate and significant bearish impact.

FX/bond correlations elect a short EURJPY as the best hedge. A scenario with the OAT Bund widening to 150bp would send the EURJPY to 108 and the EURUSD to 0.99.

A one-touch option takes advantage of the complacent relief in skew, benefits from a rise in downside vol and is the best way to catch a short-lived bottom in spot.

Buy EURJPY 3m one-touch knock-in 108 @ 13% (7 times leverage).

Rationale: The likely victory of a market-friendly candidate would redirect attention to the modalities of ECB tightening, propelling the euro gradually higher.

In contrast, a Le Pen victory would have an immediate and significant bearish impact.

FX/bond correlations elect a short EURJPY as the best hedge.

A scenario with the OAT-Bund widening to 150bp would likely send it to 109.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025