The Turkish lira is still being buffeted around from day to day by news in both directions. The currency had a good rebound so far this week following re-assurances by the economic policy management team in London that the central bank stands ready to hike rates again on 7 June.

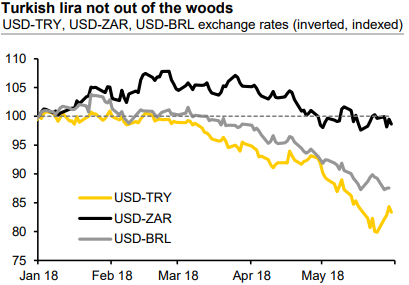

Market conditions turned somewhat more helpful too as the sell-off of Italian bonds paused. But the rebound was modest after all (refer chart) and relief did not last long: yesterday, the US dollar began to strengthen again. And from the local side, Turkish trade data reminded markets about the perils of a rising oil price: trade data for April showed noticeable widening of the deficit; exports were down 2%m/m (seasonally adjusted), imports were up 2%, which contributed to the widening.

Finally, the latest Metropoll survey highlighted a 3pp month-on-month slippage in President Erdogan's approval rating (to 46%) from the previous month – this very likely reflects opinions about his handling of the lira crisis this month.

On the one hand, the market prefers to see Erdogan's influence and interference with economic policies eliminated after the elections; but equally, it frets about broader stability should a fractious opposition coalition with no recent governing experience ascend to power. How policy will look under this scenario is a question mark. To put it bluntly – the lira is not out of the woods. If CBT were to skip a rate hike on 7 June simply because temporary calm happens to prevail at the time, that would be confirmation that, despite the assurances, the central bank's 'behind the curve' style has not changed.

Overall, the tendency for inflation would be to peak and moderate – but only slightly, say to around 9% in the coming months. This extent of moderation will not neutralize Turkey’s long-term inflation, though – at the best, it can bring near-term relief. In the medium-term term, for the stabilized lira, we, therefore, expect USDTRY to head up towards the 5.00 mark.

Trading tips:

Short 2m ATM calls, Sell 1Yx1Y USDTRY FVA vs buy 1Y ITM call.

Buy 2m USDTRY call (4.50) and EURTRY call (4.83) (equal weighted USD notional).

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One