We run you through the potential risks of the underlying pair of GBPCAD before we begin with the hedging frameworks.

The United Kingdom preliminary GDP QoQ is scheduled to be announced tomorrow, and it is anticipated to have inched up to 0.6 pct in Q2, from the first, when it rose 0.4 pct. The report is expected to flash that business investment struggled leading up to the Brexit vote.

Moreover, in the UK, the central bank began with easing bias by cutting bank rates by 25bps to keep it at 0.25%, all MPC members unanimously voted for this decision (0-9-0).

Amid current upswings in this pair, it has shown a decline of around 11.57%, i.e. dips from the highs of 1.9302 to the current 1.7068 levels in just last three and a half months, the pair.

The main reason behind this decision is that the BoE would not want to add any extra strain on the markets and the British economy in conjunction with the Brexit apprehensions by allowing any speculation about an adjustment of its monetary policy.

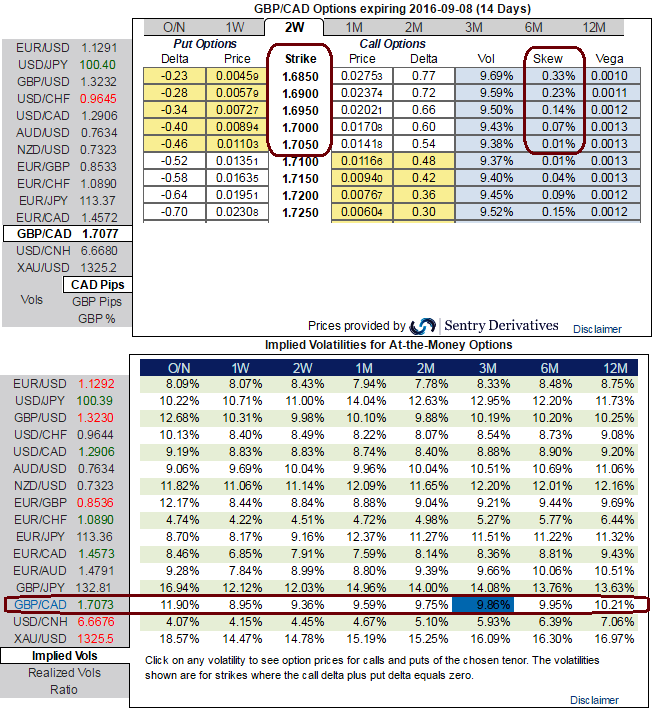

In OTC markets, ATM IVs seem to be quite on the edge to factor in the weakness in this pair as we could see a reasonable increase in IVs of 2W and 1M tenors. As a result, we recommend capitalizing on the sustainable IV factor by employing ITM short puts as the central bank's decision was also in line with market's expectations and matching this with ATM longs to construct short-term back spreads that are likely to fetch positive cash flows as per the indications by sensitivity table.

When trying to assess how a spread may perform, looking at the 3m IV skews spreads of deeper in the money option shorts for an indication of relative option prices. (For a demonstrated purpose we’ve used 1% ITM instruments, in real times use longer expiries on ATM longs.

So, keeping all these attributes in mind, here goes the strategy, go long in 1M 2 lots of ATM -0.50 delta put, and in 2M (1%) OTM -0.36 delta puts, while shorting 1 lot of ITM put (0.5%) put with 2-week expiries.

Subsequently, the slight upward or sideway swings would derive the positive cashflows through the initial receipts of shorts which could be utilized for reducing hedging cost.

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure