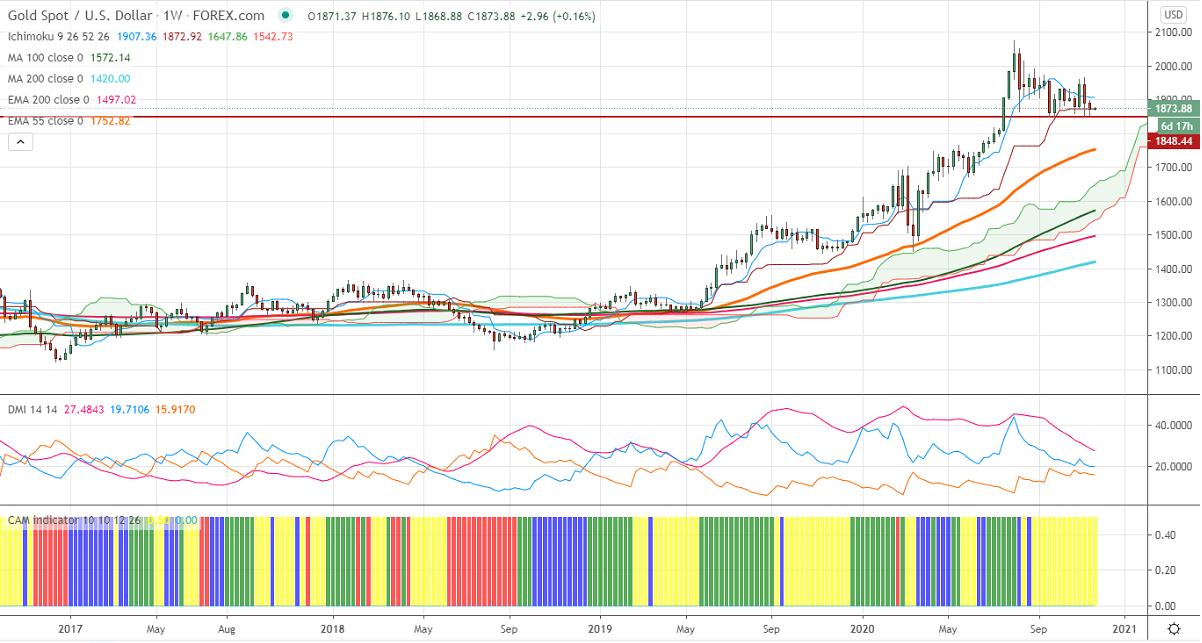

Ichimoku analysis (Weekly chart)

Tenken-Sen- $1911.20

Kijun-Sen- $1872.90

Gold has once again taken support near $1850 and shown a minor jump. The highlights of this week are a surge in daily coronavirus cases in the US to a record high. The hopes of the virus vaccine are putting pressure on the yellow metal at higher levels. The dollar index upside capped by 200- day EMA, any violation above 93.20 confirms further bullishness. The US 10-year yield declined more than 10%after hitting a multi-month high.

Economic data:

The number of people who applied for unemployment benefits raised by 31000to 742000 vs an estimate of 707k. The US retails sales came at 0.3% for October slightly below the estimate of 0.5%. US housing starts climbed 4.9% in October at 1.53 million units, while building permits came flat.

Technical:

In the Weekly chart, Gold is facing strong support at $1849 (Sep 24th low). Any break below will take the pair till $1830/$1800. On the higher side, near term resistance is around $1900 and any indicative break above that level will take till $1922/$1935/$1955.

It is good to buy on dips around $1860 with SL around $1840 for the TP of $1950.