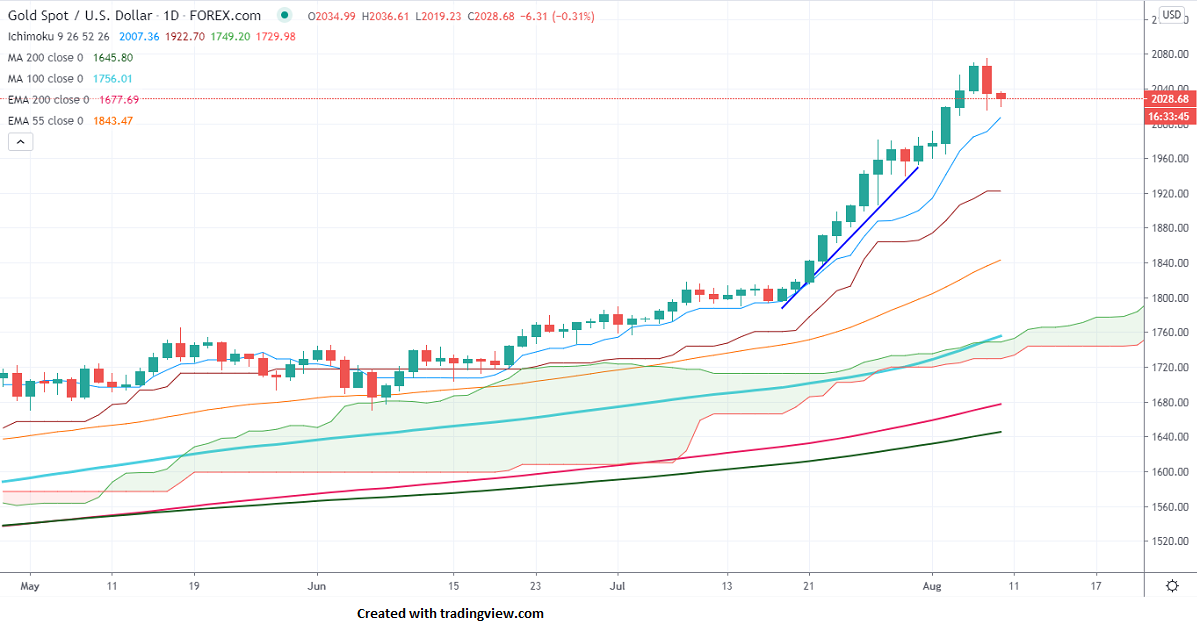

Ichimoku Analysis (Daily Chart)

Tenken-Sen- $1991

Kijun-Sen- $1922

Gold declined more than $40 after upbeat US jobs data. The US economy has added 1763K jobs in Jul compared to an estimate of 1530K and unemployment at 10.2% vs 11.1% previous month. The US 10-year bond yield shown a good recovery of nearly 2% on upbeat US jobs data. The US 10-year inflation-adjusted yield is at -1.04% vs -1.08% on Aug 6th. Gold and US real yields are inversely proportional and this confirms that gold to trade further higher in the coming months. Markets eye US Non-Farm Payroll data for further direction.

US Dollar Index – Bullish (negative for yellow metal)

S&P500- Positive (negative for gold)

US Bond yield- Positive (negative for gold)

Technical:

The yellow metal hits an all-time high at $2074 and shown a profit booking. It is currently trading around $2029.50.

The immediate support is around $2015, any indicative break below targets $2000/$1980. The near term resistance is at $2040, the violation above will take the commodity to next level $2075/$2100.

It is good to sell on rallies around $2060-61 with SL around $2075 for the TP of $1910.