The precious yellow metal finally seems to have taken a halt after a commendable bullish rout, after it hit all-time highs of $2,075 levels, Gold prices sensed overbought pressures. As a result, CME gold futures traded lower earlier today as the number of first-time U.S. unemployment claims tumbled below 1 million mark over the weekend (perhaps due to the Covid19-pandemic), which has been perceived as a slightly bearish driving force for the safe-haven.

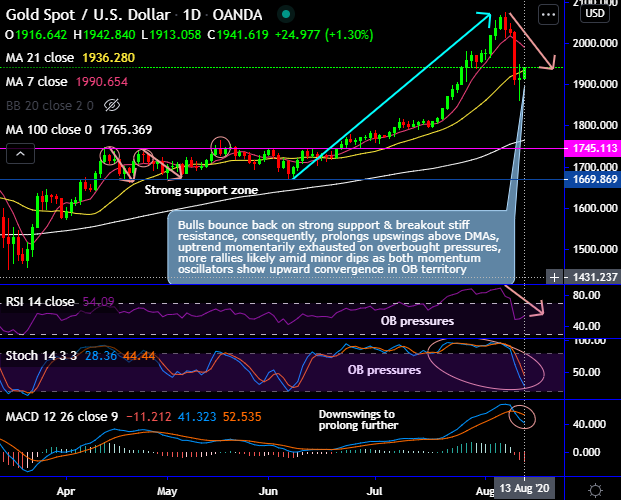

Technically, prior to the most recent price developments, XAUUSD bulls bounce back upon the test of strong support & breakout stiff resistance decisively that prolongs upswings above DMAs. For now, the uptrend momentarily seems to have been exhausted on overbought pressures signaled by the leading oscillators (RSI & Stochastic curves, refer daily chart). Please be noted that more rallies are still likely amid minor dips as both momentum oscillators show upward convergence on monthly plotting.

On a broader perspective, the bulls extend saucer pattern and retraces more than 88.6% Fibonacci levels & hits all-time highs, while both leading and lagging oscillators substantiate the major uptrend (refer monthly chart).

Whether we look at retail investors’ gold allocations or the spec positions on gold futures by hedge funds, we could foresee further room for the gold rally to continue amid some price corrections.

Trade tips:

At spot reference: $1,946. level (while articulating), on trading grounds, boundary options trading strategy with upper strikes at $1,991 and lower strikes at $1,862 levels. The strategy is most likely to fetch assured yields as long as the underlying spot price remains between these two strikes on the expiration.

Alternatively, on hedging grounds, we already advocated long positions CME gold contracts, as we could foresee more upside risks and intensified buying interests on safe-haven sentiments amid geopolitical turmoil and the global financial crisis, we wish to uphold long hedges by rolling over to August’2020 deliveries.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data