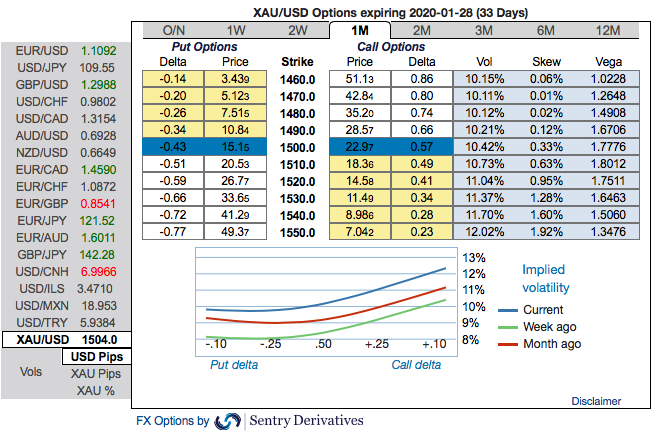

Gold’s 1-month ATM vol spiked from 8.5 vols to 10 vols in the middle of the week only to fall back to 9 vols again as spot prices fell sharply on Friday following the strong US jobs report. Positively skewed IVs have been stretched on either side, we could see bids for both OTM call and OTM put strikes. We think this is a good opportunity to sell 1M ATM vol that has recently seen a spike in its sell vol signal. The sell signal strength spiked on Tuesday to a level that is above the 95%-tile of its range and has stayed there consistently throughout the week.

We would also consider selling 3M ATM vol instead due to the fact that the 3M ATM vol level is 15% higher in vol terms than the 1M ATM vol level, which is a fairly high spread level historically. At our current prices, we recommend selling 3M ATM vol at 9.9 vols or selling 1M ATM vol at 8.8 vols, indicatively.

While Gold and Palladium are already far into an internal 3rd wave rally of greater scale, we see great catch-up potential for Silver and Platinum, which are still in the very early stages of it. In line we see the Gold/Silver spread trading significantly lower.

What is more eye-catching is the 2019 gamma outperformance, in our view. Bucking the long-term strongly negative trend, 3M delta-hedged straddles are up 1.6vols YTD. Theta friendly long gamma / short vega calendars were particularly efficient in exploiting the gamma performance.

Amid festive season, XAUUSD Strangle Shorts appear to be suitable. Contemplating the major trend that has been range-bounded (oscillating between 1,550 and 1,445 levels), it is wise to deploy (0.5%) out-of-the-money call and (0.5%) out-of-the-money put options of 2w tenor. The strategy can be executed at the net credit and certain yields would be derived in the form of initial premium received as long as the underlying spot FX remains between OTM strikes on the expiration.

Alternatively, we advocated buying delta-hedged 1Y XAUUSD 1*2 ATM/25D strikes ratio call spread @12.2ch vs 15.25/16.25indic, vega notionals, spot reference: $1,503 levels). Courtesy: Sentry & JPM

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge