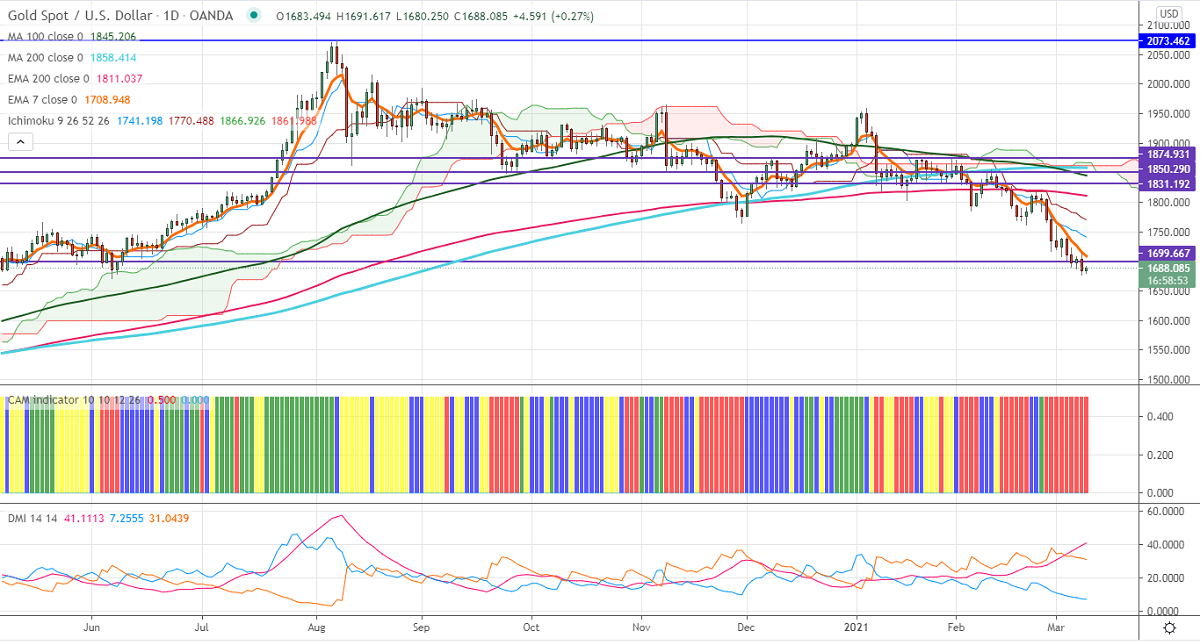

Ichimoku analysis (Daily chart)

Tenken-Sen- $1745

Kijun-Sen- $1774

Gold continues to trade weak and hits the lowest level since June 2020 on strong US dollar index and surging yield. DXY is holding well above 92 levels, a jump till 92.73-92.91 (200- day EMA and MA) is possible. The minor jump in US indices is also putting pressure on the yellow metal at higher levels. The US 10-year bond yield jumped more than 17% this month.

Technical:

It is facing strong resistance at $1715 (7- day EMA), violation above targets $1745/$1760$1645 (161.8%)/$1637. On the higher side, near-term support is around $1675, any indicative break below that level will take the pair to $1650/$1637.

It is good to sell on rallies around $1701-02 with SL around $1720 for the TP of $16