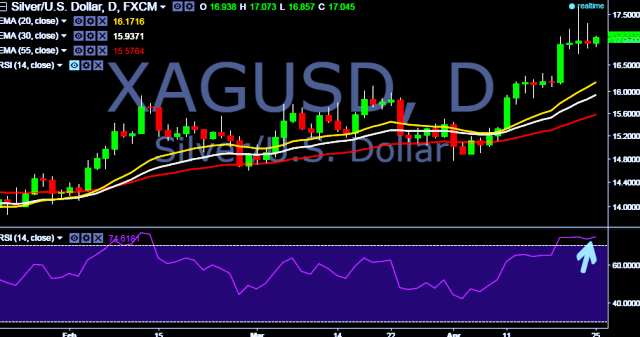

- XAG/USD is currently trading around $17.01 marks.

- It made intraday high at $17.02 and low at $16.85 levels.

- Intraday bias remains bullish till the time pair holds immediate support level at $16.85 marks.

- On the top side, key resistance is seen at $17.22. A sustained break above will take the parity up towards $17.37/$17.45/$17.68 levels.

- Alternatively, a daily close below $16.88 will drag the parity down around $16.81/$16.70/$16.42 levels respectively.

- Initial support levels are seen at $16.92, $16.88 and $16.82 marks.

- Resistance levels are seen at $17.02, $17.14 and $17.21 thereafter.

We prefer to take long position in XAG/USD above $17.02, stop loss $16.88 and target $17.21/$17.37 marks.