TWD FX long positions were initiated during Christmas festive season on the prospects of improved US-China trade relations and very attractive valuations on our fundamental metrics (PPP / REER / NIIP stabilization). These two factors still very much remain in play, however,

1) intensifying concerns on global growth / Taiwanese exports and

2) a change in onshore regulations which reduces USDTWD selling flows from lifers are forced to exit the trade.

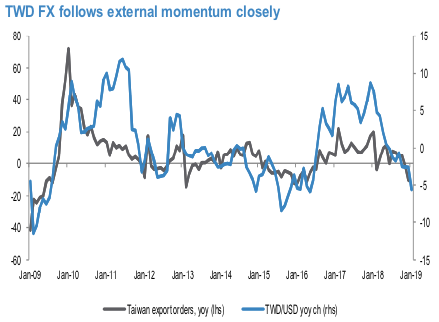

Taiwan export growth is now in negative territory and export orders have fallen back to early 2016 lows, with TWD FX moving in sync with such trends (refer above chart). Whilst it is fair to say that the currency is pricing in some of this weakness already, the continued downtrend in both the Taiwan and China economic activity surprise indices (EASIs) suggest concerns around the regional/global growth backdrop and supply chain demand will persist in the near term. To be sure, stimulatory efforts by the Chinese authorities should help stabilize activity momentum in the coming months but at the same time, this could be offset by US downside risks, particularly as the government shutdown continues.

The changed regulations reduce USDTWD selling flows. Local reports indicate that the FSC has agreed to increase the monthly forex reserve ratio for changes in FX valuations for life insurance companies starting from January. By way of background, Taiwan’s life insurance industry holds TWD16.3tn in foreign assets (69% of total invested capital), reflecting a lack of attractive domestic fixed income assets. This large stock of offshore assets has created a currency mismatch challenge given liabilities are mainly TWD-denominated savings-type policies.

Life insurers use currency swap and NDFs to hedge the majority of their foreign assets, but there remains a part that is FX unhedged. For that part, life insurers each month put aside capital worth 0.05% of the underlying overseas investment with FX exposure (known as the monthly reserve ratio) into a “forex reserve” pool. 50% of monthly FX translation gains/losses stemming from unhedged FX asset are allowed to go in and out of the “forex reserve” pool to reduce earnings volatility. Given increasingly wider US-Taiwan interest rate differentials stemming from Fed hikes, hedging costs have been rising and hurting earnings. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly CNY spot index is flashing at -100 levels (which is bearish), hourly USD spot index was at 65 (bullish) while articulating at (12:08 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge