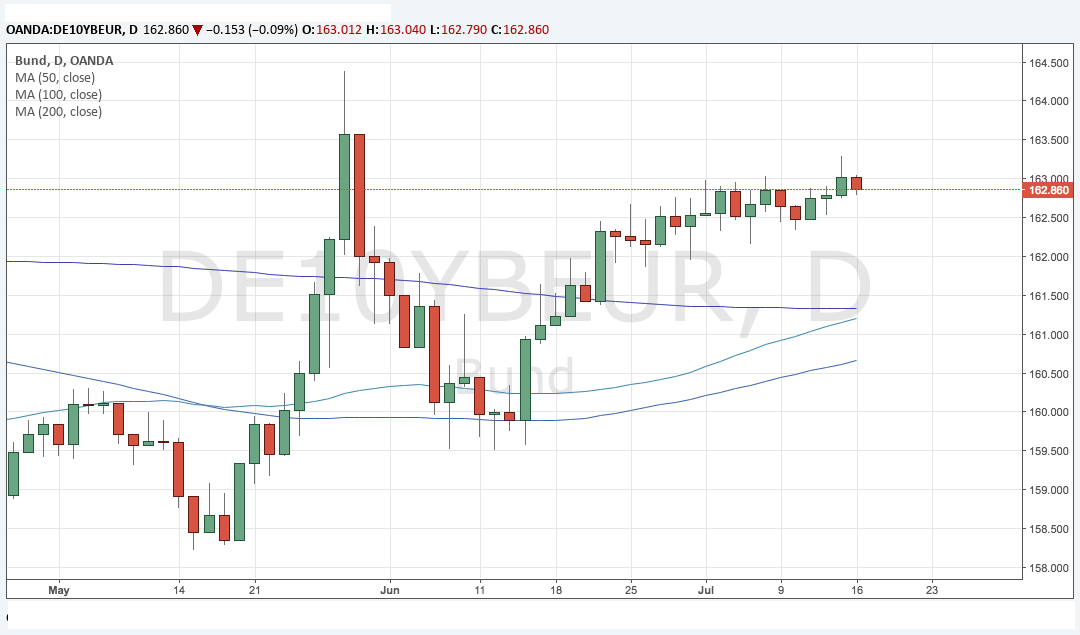

The German bund prices are expected to remain weak for a short period, following the improvement in investors’ risk appetite as the U.S.-China trade tensions started to ease, after a lengthy period of uncertainties and trade war worries.

Investors will now keep an eye over Eurozone’s consumer price inflation for the month of June, scheduled to be released on July 18 by 09:00GMT and of utmost importance, on the summit between U.S. President Donald Trump and Russian counterpart Vladimir Putin, scheduled to be held today in the Finnish capital, Helsinki.

Although prices remain volatile in a fluctuating market scenario over past few days, any steep fall could see prices plunging below 162.154 and bearishness below could drag till 161.34 (200-day MA).

The German 10-year bond yields, which move inversely to its price, rose 1 basis point to 0.29 percent, the yield on 30-year note also edged higher by nearly 1 basis point to 1.02 percent and the yield on short-term 2-year traded tad higher at -0.65 percent by 09:50GMT.

The coming week’s euro area data calendar is relatively sparse. June trade figures will be announced today, with new car registration numbers due tomorrow. Wednesday brings final euro area inflation figures for June.

While a downward revision was seen in France, the euro area numbers still seem highly likely to confirm the flash estimates, with headline inflation up 0.1ppt from May to 2.0 percent y/y, but core inflation down 0.1ppt to just 1.0 percent y/y, still firmly within the range of the past four years. Construction output figures for June are also due on Wednesday. And the ECB’s euro area balance of payments are due at the end of the week.

Lastly, U.S. President Donald Trump has said ties with Russia have "NEVER been worse" and blamed US politicians, ahead of his first-ever summit with counterpart Vladimir Putin. In a tweet the US president denounced his predecessor's "stupidity" and the "rigged" inquiry into alleged Russian interference in the 2016 election, BBC News reported.

Meanwhile, the German DAX traded 0.17 percent higher at 12,561.97 by 10:00GMT, while at 10:10GMT, the FxWirePro's Hourly Euro Strength Index remained neutral at 43.86 (higher than +75 represents bullish trend). For more details, visit http://www.fxwirepro.com/currencyindex

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks