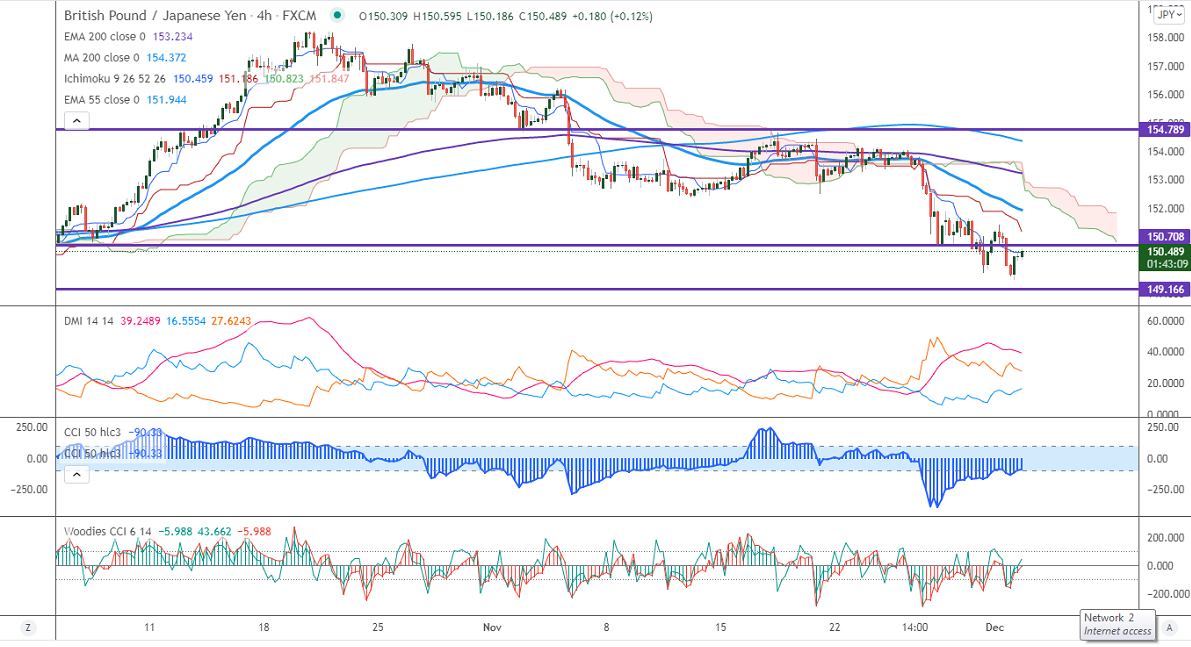

Major Intraday resistance -150.85

Intraday support- 149

GBPJPY hits a six-week low and shows a nice pullback on weakness in the Japanese yen. The pound sterling dropped below 1.3300 levels on the Brexit issue and spread of the Omicron virus across the globe. Any breach above 1.3360 confirms intraday bullishness. The IHS Markit CIPS PMI rose to 58.1 vs the forecast of 58.20. The intraday trend of GBPJPY is neutral as long as resistance 152 holds. It hits a high of 150.59 at the time of writing and is currently trading around 150.45.

USDJPY- Analysis

The pair pared some of its loss made yesterday on upbeat market sentiment. Any jump above 114 confirms a bullish continuation.

CCI Analysis-

The CCI (50) and Woodies CCI are holding below zero level in the 4- hour chart. It confirms a major bearish trend.

Technical:

The immediate resistance is around 150.85, any break above targets 151.60/152/152.50/153/153.45. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is around 150. Any indicative violation below targets 149.40/149/148.

Indicator (4-Hour chart)

Directional movement index –Bearish

It is good to sell on rallies around 150.55-60 with SL around 151.50 for a TP of 148.