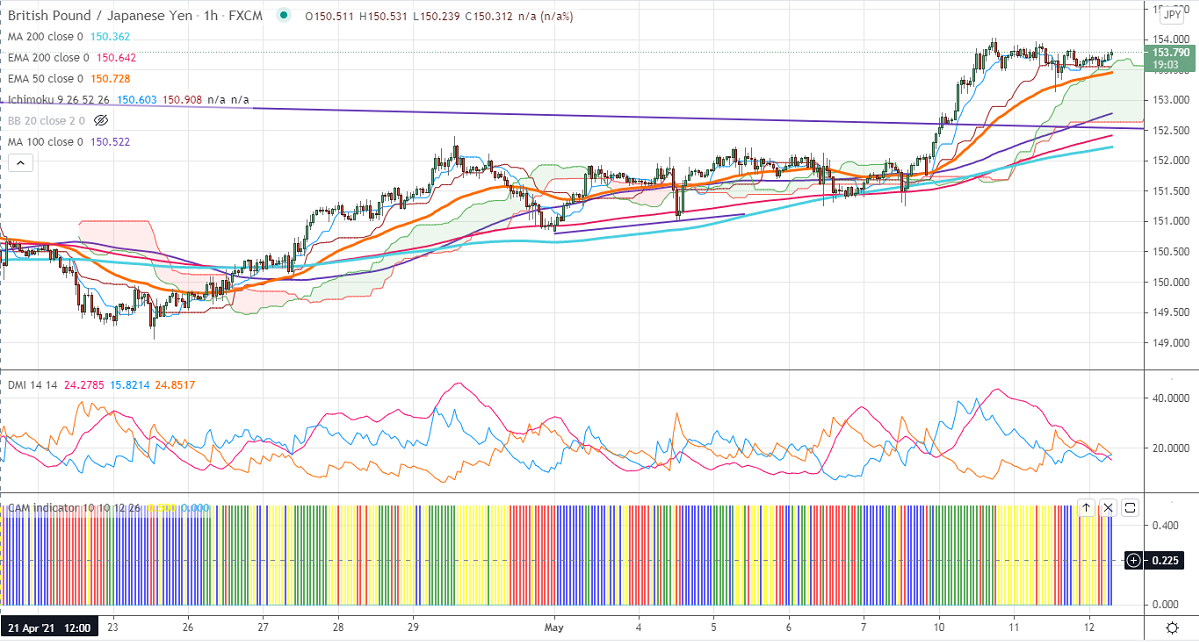

Ichimoku Analysis (4-Hour Chart)

Tenken-Sen- 152.89

Kijun-Sen- 152.63

GBPJPY is consolidating after hitting three years high at 154.02. The surge in pound sterling for the past two weeks is supporting the pair at lower levels. GBPUSD is holding well above 1.4000 on a sharp decline in the number of corona-related deaths and easing restrictions. UK final GDP rose by 2.1% in Mar compared to a forecast of 1.5%. While UK's First Quarter GDP contracts by 1.5% slightly above economists' 1.7% drop. USDJPY is trading below 200-W MA and any violation above 109.07 confirms intraday bullishness. The intraday trend of GBPJPY is bullish as long support 153.40 holds.

Technical:

The pair's near-term resistance around 154, any break above will take the pair to next level till 154.40/155/156. On the lower side, near-term support is around 153.40. Any indicative violation below that level will drag the pair down to 152.80/152.30/152. Significant trend reversal only if it breaks below 147.40.

Ichimoku Analysis- The pair is trading above 4-hour Kijun-Sen and below Tenken-Sen, cloud.

Indicator (4-Hour chart)

CAM indicator –bullish

Directional movement index –Bullish

It is good to buy on dips around 153.25-30 with SL around 152.80 for a TP of 155.