Sterling continued to slip yesterday as this week’s sell-off took the pound to its lowest level against the US dollar since January. The pound has also fallen against the euro although the latter is down against the US dollar.

The government announced the fourth vote on the exit agreement with the EU for 3rdJune. A statement from Graham Brady, the head of the UK Conservative backbench 1922 Committee, stated that he will meet with PM May to set a date for her to resign as party leader following a Parliamentary vote on the EU Withdrawal Bill in the first week of June. Meanwhile, reports suggest that the cross-party Brexit talks between the Tories and Labour are set to end today without a deal being struck.

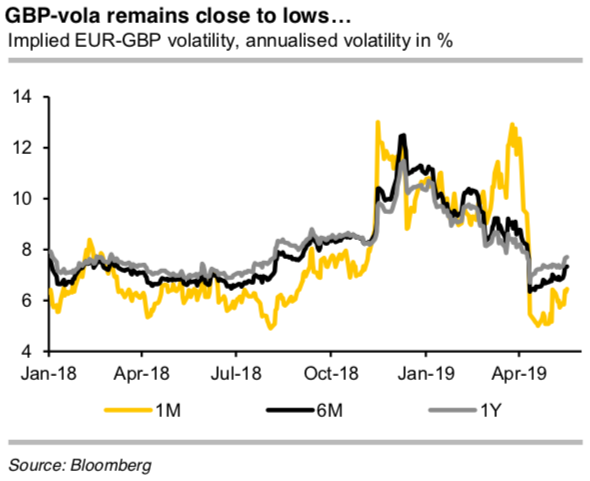

Under such circumstances, we reckon that it is completely incomprehensible why implied volatility both for the next month (until about a week after the vote) and longer term until after the Brexit date at the end of October remain close to last year’s low. It has always been interpreted the combination of low implied volatility (refer 1st & 4th chart) and nonetheless raised (long term) EURGBP risk reversals (refer 2nd & 3rd chart) that we had seen since Brexit was postponed as meaning that the market expects a long period without progress – hence the low vol – but doesn’t expect a deal as a deal would be GBP positive and would, therefore, point towards lower risk reversals; i.e. the market seems to expect a probably continued Brexit delay.

However, that seems increasingly unrealistic. After the vote the situation is wide open again: either May manages to secure an orderly Brexit which would reduce GBP downside risks considerably, or a new Prime Minister brings new uncertainty and probably a tougher Brexit stance. Hence, we could foresee short term potential for a correction on the options market and space for further GBP depreciation. Courtesy: Sentrix, Saxo & Commerzbank

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -146 levels (which is highly bearish), while EUR is at -50 (bearish), while hourly USD spot index was at 150 (highly bullish) while articulating (at 10:11 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms