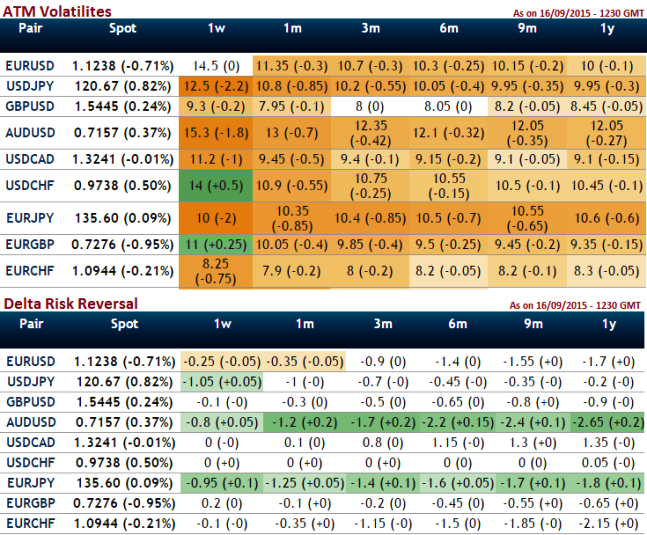

On the verge of important day in U.S. as there are no significant data releases from U.K side that could propel GBP today except retail sales, GBPUSD may likely to experience random walk for today. Hence, we believe pound sterling is waiting curiously to get benefitted from any outcome of the rate decision. However, it would absolutely be puzzling trend as you can make out from the nutshell showing IV and delta risk reversal; GBPUSD is to have the least IV among G7 currency pool but for today trades cannot afford to be at risk, hence below option strategies are advised.

Option trade recommendations:

Condor spreads for risk averse: Since the GBPUSD's implied volatility is perceived to be comparatively minimal from other major G7 pairs (at around 9.3%), so here comes option strategy for regular traders of this currency cross when there is big economical event is scheduled. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

The trader can construct a long condor option spread as follows ideally for the short call spreads to expire worthless. The trader can implement this strategy using call options with similar maturities. So strategy goes this way, writing an (-1%) In-The-Money call and buying deep striking (-1.5%) In-The-Money vega calls, writing a higher strike (1%) Out-The-Money calls and buying another deep striking (1.5%) Out-Of-The-Money vega call for a net debit.

Straddles for speculators: GBPUSD's non directional pattern is persisting but some bearish indications from risk reversal computations, as it is highly unpredictable of today's trend of this pair we like to remain in safe zone but certainly not miss out chances of speculation. Thus, we recommend buying option straddles, deploy straddles using At-The-Money calls and puts in this dubious situation, thereby, one can benefit from certain returns even if the pair breaks out on either side.

FxWirePro: GBP/USD option straddles for aggressive traders and condor spreads for laggards on big day in U.S

Thursday, September 17, 2015 7:20 AM UTC

Editor's Picks

- Market Data

Most Popular

2