Are you dubious on sterling’s trend..? Having hit its weakest point against the euro since last October’s ‘flash crash’, the pound is now consolidating around 1.3179 again dollar and 0.8927 against euro.

However, both constituent currencies are struggling for direction, caught between the conflicting considerations of heightened political uncertainties and potentially tighter monetary conditions. The most pressing matters of late have been politically orientated. The stalling Brexit negotiations have weighed on GBP in particular.

At the same time, the market may have mispriced the European political risk premium post-Macron, which when re-evaluated, may put downward pressure on the EUR. In contrast, both currencies have been supported by less ‘dovish’ stances from their respective central banks.

Following the Bank of England’s (BoE) September meeting minutes and subsequent speeches from Monetary Policy Committee (MPC) members, including Governor Carney, we anticipate the first UK Bank rate hike in over a decade in November.

Meanwhile, the European Central Bank (ECB) is set to announce its medium-term plan for its quantitative easing program at its October policy meeting, which will be influential in driving European interest rate expectations.

Thereby, the pound is deemed to be caught up between politics and interest rates.

Balancing all factors, we see EURGBP limited to a medium-term range, forecasting around 0.90 for end-2017 and 0.92 for end- 2018.

Given the lack of clarity on a number of these key risks, it is unsurprising to still see significant degrees of divergence in broad market expectations, while GBPUSD has been drifting downward to stay in a range of the daily terms, even on monthly terms price remained in range from last 3-4 months (1.3268 - upper range and 1.2589 levels – lower range). After shooting star candle formation at 1.2916 levels, thereafter, bears have managed to slide the prices below DMAs.

Last week, although bulls have attempted to bounce back but again restrained below 21DMAs, as a result, you could trace out a hanging man pattern candle at 1.2928 levels, while RSI signals faded strength in previous rallies.

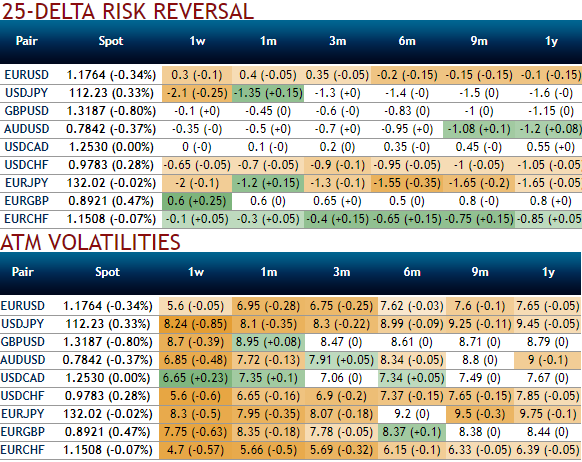

Please be noted that the GBPUSD's implied volatility is perceived to be on a lower side (below 9% in 1m tenors) along with bearish neutral risk reversal sentiments, accordingly we construct multiple legs of option strategy for regular traders of this currency cross when there is little IV.

GBPUSD's lower IVs with bearish neutral delta risk reversals could be interpreted as the option writer’s opportunity in short run. Thus, exploiting on lower IVs we eye on shorting calls with shorter expiries which would lock in certain yields by initial receipts of premiums.

A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

Using options expiring on the same expiration month, the options trader creates an iron condor by selling a lower strike OTM put and buying an even lower strike out-of-the-money put, similarly shorting a higher strike OTM call and buying another even higher strike out-of-the-money call.

This results in a net credit to put on the trade.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays