More worsening in macro risk sentiments drove GBPJPY sharply lower from last couple of week to temporarily below 165 despite the BoJ adoption of negative interest rates policy (NIRP) and some official jawboning. Given fear of broader global risk outweighing worries about further BoJ policy.

From the recent rate change by BoJ makes commercial banks that park surplus reserves at the central bank to negative 0.1% in a slightly awful stimulated pointing at serving its economy to cushion the potential threats of deflation.

Elsewhere, we look ahead for December Machinery Orders on Wednesday to have an increase of +7.7% MoM versus forecasts at +4.6% and look for January Trade Balance on Thursday to show JPY-782bn of deficit versus forecasts at 647bn.

BoJ says based on estimates made on current account deposits for Jan, negative rates will apply to roughly 23 trln yen.

On flip side, the GBP will likely be supported by an expected uptick in today's CPI numbers. It is forecasted for January headline CPI to print at 0.3% YoY, as the major driving forces from crude oil prices and food price wars fall out, while core CPI is expected to remain unchanged at 1.4% y/y.

We look ahead for a solid employment report on Wednesday, finally, we expect total retail sales (Friday) to accelerate 1.3% m/m (4.1% y/y) (consensus: 0.8% m/m, 3.6% y/y) after a significant downside surprise in December.

Overall trend of this pair fixes it bearish view for a target of 160.207 and may even tumble up to 156.480 in near terms.

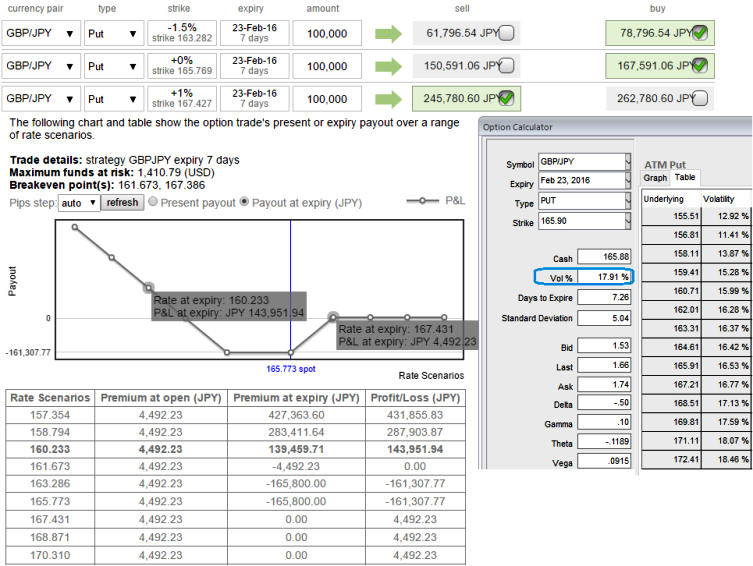

Good news for option holders as the ATM IVs still trending at 17.91% which is at higher side. We can ponder arresting this potential downside risks through Put Ratio back Spread in 2:1 proportion and is more effective hedging strategy than any other means when one could sense more bearish momentum with spiking IVs.

So, as shown in the diagram stay short buying 2W at the money -0.51 delta put, 1M (1.5%) out of the money -0.31 delta put that would function effectively. While simultaneously, short 1 lot of 4D (1%) ITM put option would generate assured returns on any abrupt rallies, shortly longs on ATM puts are about to function that would take care of potential downswings.

Alternatively, if they wish to short OTM instruments, they sell puts that has delta of less than 0.15. Which means they sell deep out of the money options. The idea behind this trade is that the chance of this option to expire worthless is 85%. (1-0.15 = 0.85 or 85%).

The delta of a back spread or ratio spread is generally dominated by the option with the greater quantity the further it is from expiration. That makes sense, because the more days to expiration, the deltas of options are not as close to 0.0 or 1.00 as they are when there are fewer days to expiration.Please be noted that the expiries used in the diagram are only for demonstration purpose, use shorter expiries on short side (preferably 4D or 1W maturities).

FxWirePro: GBP/JPY bulls eye on UK data season while bears eye on BoJ minutes - stay hedged via 2:1 spreads

Tuesday, February 16, 2016 9:22 AM UTC

Editor's Picks

- Market Data

Most Popular

5

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook