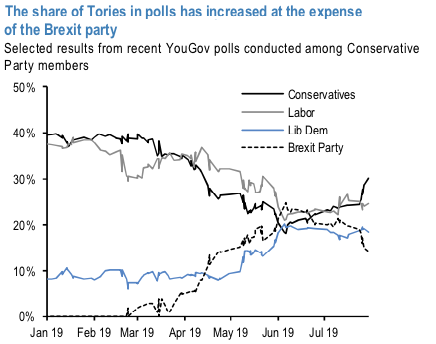

We continue to remain short GBP as a tail hedge in our portfolio on Brexit uncertainty but continue to do so via a limited downside put spread, having unwound our outright spot shorts last week. An important marker to watch aside from political developments on Brexit negotiations are polls for the general elections, but there were no additional releases this week. The latest polls from last week had shown that the share of Tories has unsurprisingly increased at the expense of the Brexit party (refer 1st chart), but was not yet at levels which would indicate a definitive majority (shares in polls exceeding 35-37% would be more favorable).

With the vote split the way it is currently, it is less easy to predict seat distribution and hence the situation remains fluid. For markets, either outcome—an election of a Conservative party pushing an uncompromising hard Brexit or the possibility of a Labour administration if Johnson’s strategy fails—presents an unfavorable outcome.

The other marker to watch is positioning in GBP. Investor shorts have admittedly gone up and posed some risk of a short squeeze. The magnitude of shorts is now only 20% smaller than the 2017 lows (refer 2nd chart).

A macro catalyst for reversal is absent in our view, but this is yet another reason to maintain hedges via options.

OTC outlook and Hedging Strategy: Please be noted that IVs of this pair that display the highest number among entire G7 FX universe.

While the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 124 levels (refer above nutshells evidencing IV skews). Hence, it is wise to capitalize on momentary upswings of GBPJPY and deploy OTM put writing.

Hence, put ratio back spreads (PRBS)are advocated on the hedging grounds. Both the speculators and hedgers who are interested in bearish risks are advised to capitalize on current abrupt and momentary price rallies and bidding theta shorts in short run, on the flip side, 3m skews to optimally utilize delta longs.

Capitalizing on abrupt minor upswings, we advocate shorting 2m (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, go long in 2 lots of delta long in 2m ATM -0.49 delta put options (spot reference: 128.604 levels). Courtesy: Sentrix & JPM

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields