As for monetary policy, we remain to be convinced that a modest increase in UK rates over and above what is now priced (we expect 50bp this year) will be a game-changer for GBP. Growth may have improved in the UK but the country is still a clear laggard within G10 and monetary tightening is merely reducing the highly negative level of real UK rates. The Brexit vote may not have reduced the current account deficit to a more normal level notwithstanding the collapse in GBP (the deficit is currently averaging 4.5% of GDP), but it has led to a collapse in long-term capital inflows and so presents the UK with short-term financing requirement of around 5.5% of GDP.

The rate of inflation across the UK stood at 3% in January 2018, unchanged from the previous month and above market expectations of 2.9%. Sterling seems to be bearish as UK CPI peaks and wage growth fails to accelerate to 3%.

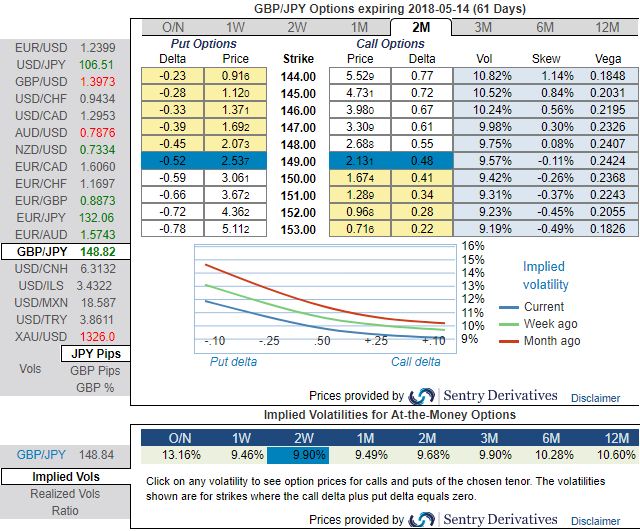

Well, ahead of UK CPI and BoE monetary policy, please be noted that the positively skewed IVs of GBPJPY of 2m tenors signify the hedgers’ interests in OTM put strikes (upto 144 levels) and isn’t this a luring factor for a shrewd bear. While 2w/2m IVs of ATM contracts are trending above 9.90% and 9.68% respectively that are the suitable combinations for diagonal put ratio spreads.

Because the higher IVs with well-adjusted positive skewness signify the hedgers’ interest for both OTM call/put strikes. In usual circumstances, long option position needs higher IVs for significant change in vega. Hence, we capitalize on buzzing IVs in 2m tenor for long leg and improve odds on options below strategy.

The aggressive volatility investors want to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility. Thus, ATM strikes are perceived to be more conducive than the OTMs.

Further GBPJPY upswings and/or weakness suggest building directional strategies as given below and volatility patterns at the same time.

1) In order to mitigate the mounting downside risks and keep them on the check, we advocate adding longs in 2 lots of ATM -0.49 delta puts of 2m tenor while writing 1 lot of 2% OTM put of 2w tenor.

Contemplating IV skewness and ongoing technical trend, we foresee the value of ATM options would likely rise significantly as the IVs seem to be favoring long legs of ATM strikes.

2) Dubious and risks averse traders, we advocate buying GBPJPY – USDJPY 1Y ATM straddle spread with equal JPY vega.

3) Alternatively, on hedging grounds, we advocate shorting futures contracts of near-month tenors as the underlying spot FX likely to target southwards 144 levels in the near run and 142 levels in the medium run.

Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned into 41 (which is bearish), while hourly JPY spot index was at shy above 9 (neutral) while articulating (at 07:02 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action