Despite GBPJPY downtrend seems to be intact, a lot of bad news is already priced in and digested by the market, preventing it from being overly bearish. Brexit caused two Sterling debacles, first in June with the vote and then after the summer when PM May suggested a hard exit. Cable lost almost about 15% over a quarter and it now seems the dust has settled. In the process, volatility fell but remained relatively high on a historical basis. Assuming a medium-term range in cable and that negative surprises are no longer market tail risks, the GBP volatility is still a short.

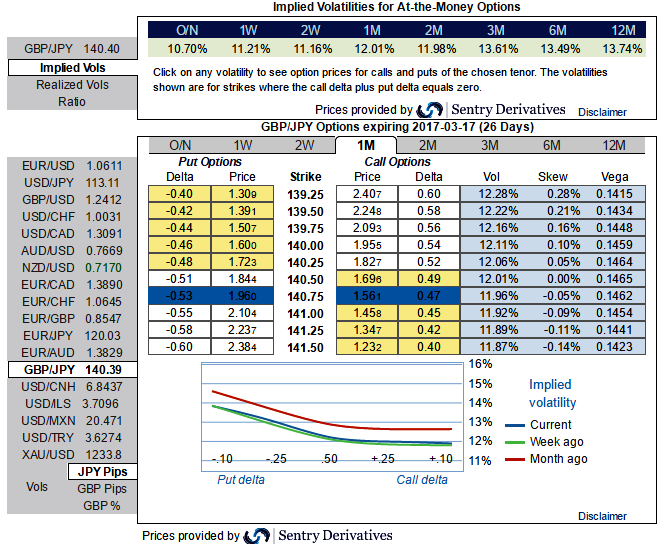

Please be noted that the 1m implied volatilities are spiking above 12% ahead of following data events, while positively skewed IVs signifies the hedging interests in OTM put strikes.

Data schedules:

In the UK: Second estimate GDP QoQ on Feb 22nd, Manufacturing PMIs on March 1st, Construction PMIs on March 2nd and Service PMIs on March 3rd, annual budget release on March 8th, BoE’s monetary policy on March 16th.

In Japan: Final GDP QoQ and current account balance on March 7th, BoJ’s monetary policy on March 15th.

Even if the aggressive volatility investors wants to capture GBP should consider buying ATM put instruments and/or being long of the smile convexity, against ATM volatility. But further GBPJPY weakness and/or abrupt upswings suggests building a directional and volatility patterns at the same time: the value of OTM puts would unlikely to rise significantly as the IVs do not seem to be favoring these distant strikes. We, therefore, recommend buying a 1m2w IV skews and risk reversal with ATM options.

Option Trade Recommendation:

In order to match above IV skewness for 1m2w tenors, we advocate initiating longs in 2 lots of 1m ATM -0.49 delta puts, while long in 1 lot of +0.51 delta call of 2w tenor, please be noted that the payoff function of the strategy likely to derive positive cashflows regardless of swings but more potential from 2 puts are more than 1 call.

The risk is limited to the extent of the price paid to buy the options.

The reward is unlimited till the expiry of the option.

Please note that the trader can still make money even if his anticipation goes wrong – but the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure