As stated in our earlier post on this pair’s technical lines, bears have extended slumps below 61.8% Fibonacci retracements and major downtrend still seems bearish despite abrupt upswings.

We continue to maintain our bearish stances as the on-going downtrend to prevail further.

As the pair has recently tested support at falling wedge baseline at 1.6757 levels, some abrupt upswings could be expected amid a robust downtrend. Well, we do not want to miss these swings with a view of profit maximization objective.

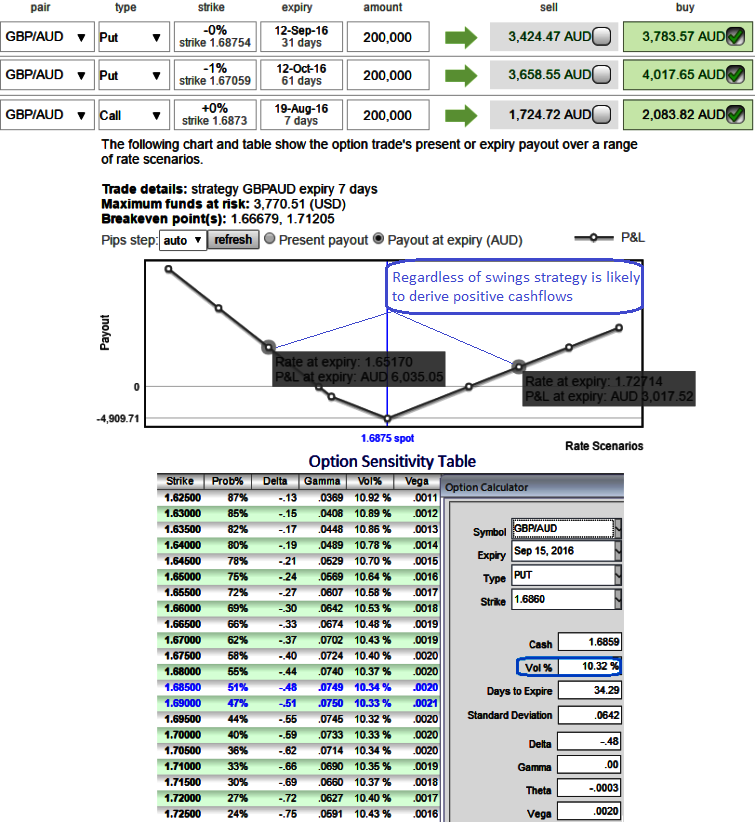

Thus, at spot ref: 1.7425 levels, as shown in the diagram the strategy could be deployed with 2 lots of longs in 1M at the money -0.49 delta puts and one can always ask – why not buy cheaper options of both the call side and the put side. Well yes you will save money but the risk will also increase, 2M (1%) out of the money -0.38 delta put option is also preferred, simultaneously, initiate longs in 1 lot of 1W at the money +0.51 delta call option at net debit.

These positions would effectively function to tackle both short term upswings and long term downswings in higher IV times as we’ve chosen narrow expiries, also be noted that vols and vega on either side (both ITM and OTM strikes) are almost moving in similar pace.

Risk/reward profile: See that profits from 2 puts are more than 1 call. The risk is limited to the extent of premium paid to buy the options if the underlying spot doesn’t show significant moves on any side. Returns are unlimited until the expiry of the option.

Please note that the trader can still make money even if the prediction goes wrong – but the underlying spot has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation