Overnight the Australian government rejected reports that in some Chinese ports coal imports were not being handled at all or only with delays. It was unable to make AUD retrace yesterday’s losses with these comments. The rumor brought yet another possible risk for the AUD outlook to the attention of the AUD bears, who are dominant on the markets at present anyway: the difficult relations between Australia and China, which are also affected by the contribution of Chinese companies in the development of the 5G network in Australia. If there is a risk that one of the most important commodity markets for Australia could simply disappear, AUD would be unable to benefit from a potential trade deal between the US and China.

Also, the warning of the Australian central bank governor Philip Lowe during his semi-annual hearing in front of parliament not to come to any hasty conclusions fizzled out largely unnoticed. At present AUD bears simply have the upper hand and want to see clear facts that the downside risks for the Australian economy are easing before they are willing to trade AUD at stronger levels again. Only then will the RBA consider moving away from its only recently assumed neutral approach. Short term AUD’s appreciation potential is therefore limited.

Apart from these developments, we highlighted quite a few other driving forces of AUDUSD. We could foresee AUD sliding below 0.69 scenarios if:

1) the unemployment rate moves back towards 5.5%, raising

the specter of RBA rate cuts;

2) the Fed responds to firm labor market outcomes by reinvigorating the 2019 rate guidance;

3) Financial conditions in China deteriorate materially.

AUD OTC FX Updates:

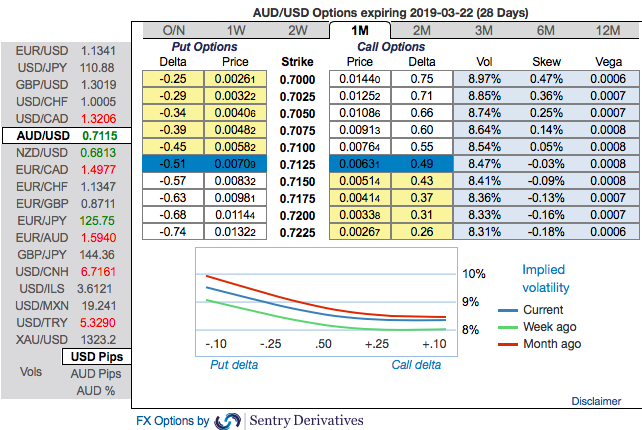

Please be noted that the positively skewed IVs of 3m tenors signify the hedgers’ interests to bid OTM put strikes up to 0.68 level which is in line with the above bearish scenarios (refer 1stnutshell). One could observe that fresh bids of bearish risk reversals across all tenors except 6m tenors that are also in sync with the bearish scenario refer 2nd(RR) nutshell.

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risks have been clear.

Most importantly, ATM put options appear to be exorbitantly priced-in. As you could easily observe that these vanilla contracts priced 18.2% more than NPV, whereas 1m implied volatilities are trending between 8.31% to 8.98%. Hence, there exists the disparity between option pricing and the IVs. Courtesy: Sentrix, Saxo & Commerzbank

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -3 levels (which is absolutely neutral), while hourly AUD spot index was at -38 (mildly bearish), while articulating (at 12:26 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One