BoE is scheduled for their monetary policy for next week. Ongoing political uncertainty indicates a continuation of the ‘wait-and-see’ message regarding the timing of the next bank rate hike.

Still, an expected upgrade to GDP growth in 2019 and the persistence of above-target inflation over the forecast horizon will do little to endorse the current ‘dovish’ market view on UK bank rate.

The urgency to hike anytime soon, however, is likely to be little changed, particularly with the outlook still clouded by the Brexit fog.

However, the quieter sentiment on the markets has got one major advantage. For all those who may not have hedged their GBP risks yet, the current situation provides a reasonably attractive entry level.

OTC outlook:

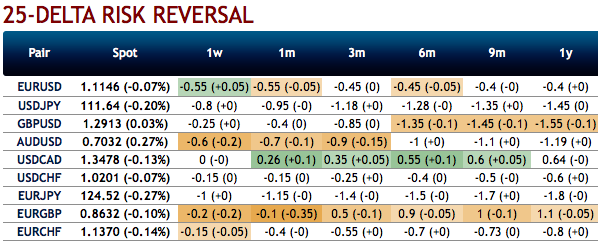

Negative bids have been observed in the GBPUSD risk reversals of 6m tenors. While positively skewed implied volatilities of 3m tenors have still stretched towards OTM put strikes. To substantiate this downside risk sentiment, risk reversals have also been signalling bearish hedging sentiments.

We reckon that the sterling should not suffer like before, but, one should not disregard the Brexit settlement risks on the other hand. The market has always ignored the fact that all the current BoE interest rate moves are due to a favourable result of the Brexit process.

Both the speculators and hedgers of GBPUSD are advised to capitalize on the prevailing price rallies for bearish risks and bidding theta shorts in short run (1m IVs) and 3m risks reversals to optimally utilize delta longs.

Strategic Options Recommendations: On hedging grounds, fresh delta longs for long-term hedging comprising of ATM instruments and OTM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way: Short 2w (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, initiate longs in 3m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in the short run and bearish risks in the long run by delta longs. Courtesy: Sentrix & Saxo

Currency Strength Index: FxWirePro's hourly GBP spot index is inching towards -77 levels (which is bearish), and hourly USD spot index has bearish index is creeping at 78 (bullish) while articulating (at 12:54 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook