Sterling has been the poorest performing among major currency space in the recent past as the market flipped the BoE from the vanguard to the rearguard of expected central bank policy normalization (the GBP NEER fell by nearly 3%).

The news flow was not universally negative –the government has moved to acknowledge the need for a lengthy Brexit transition that defers any economic adjustment for a number of years beyond the formal exit in 2019 – but weak cyclical developments are taking precedence.

In other words, the reality of a soft economy matters more for the near-term direction of the exchange rate than the expectation of a softer Brexit.

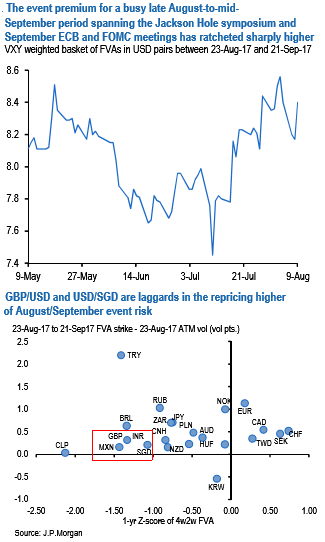

Event premium in the options market for the busy fall calendar has already ratcheted higher in recent weeks (refer above chart) and one straightforward play is to buy laggards in this repricing.

GBPUSD and USDSGD are two that fit the bill (refer above chart), with low nominal forward vols for the period covering the Jackson Hole symposium and the September ECB and Fed meetings (theoretical 23-Aug-17 to 21-Sep-17 FVA strike 7.5 for GBP, 5.0 for USDSGD) that are low by historical standards and price in only thin (< 0.5 vol) premium over pre-event dates.

Idiosyncratic vulnerabilities of the two currencies – GBP’s policy-related ones and SGD’s richness within the basket plus susceptibility to a Korea-driven regional deleveraging – are also supportive of vol ownership in these pairs. Source: JP Morgan

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays