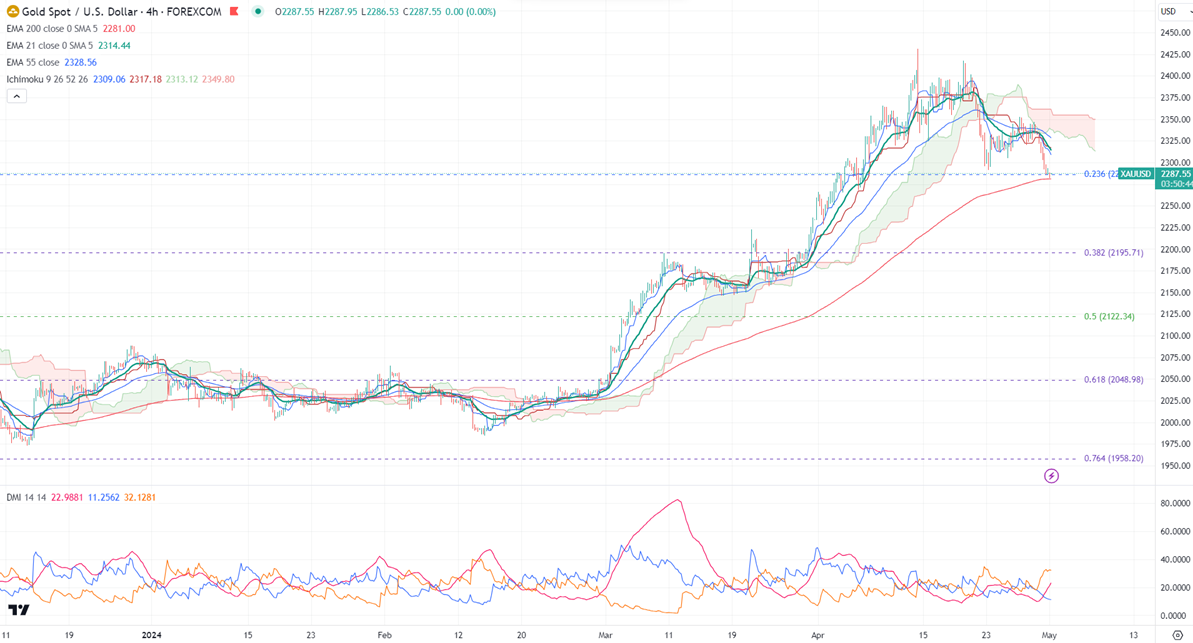

Ichimoku Analysis (4 Hour chart)

Tenken-Sen- $2316.05

Kijun-Sen- $2317.06

Gold lost its shine on the strong US dollar. It hit a low of $2281.74 at the time of writing and is currently trading around $2287.

The central bank is expected to keep rates unchanged within their current range of 5.25%-5.50%. All eyes will be on the Fed’s dot plot for further movement.

According to the CME Fed watch tool, the probability of a no-rate cut in May increased to 98.40% from 95.90% a week ago.

Conference Board consumer confidence declines to 97 in Apr vs. an Estimate of 104.

Economic data for the day

May 1st, 2024, ADP employment change (12:15 pm GMT)

US ISM manufacturing PMI (1:45 pm GMT)

Federal funds rate (6:00 pm GMT)

US dollar index- Bullish. Minor support around 105.80/105. The near-term resistance is 106.50/107.40.

Factors to watch for gold price action-

Global stock market- Bearish (positive for gold)

US dollar index - Bullish (negative for gold)

US10-year bond yield- Bullish (negative for gold)

Technical:

The near–term support is around $2280, a break below the targets of $2260/$2225/$2195. The yellow metal faces minor resistance around $2320 and a breach above will take it to the next level of $2350/$2375/$2400/$2420/$2450.

It is good to sell on rallies around $2300 with SL around $2325 for TP of $2200.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms