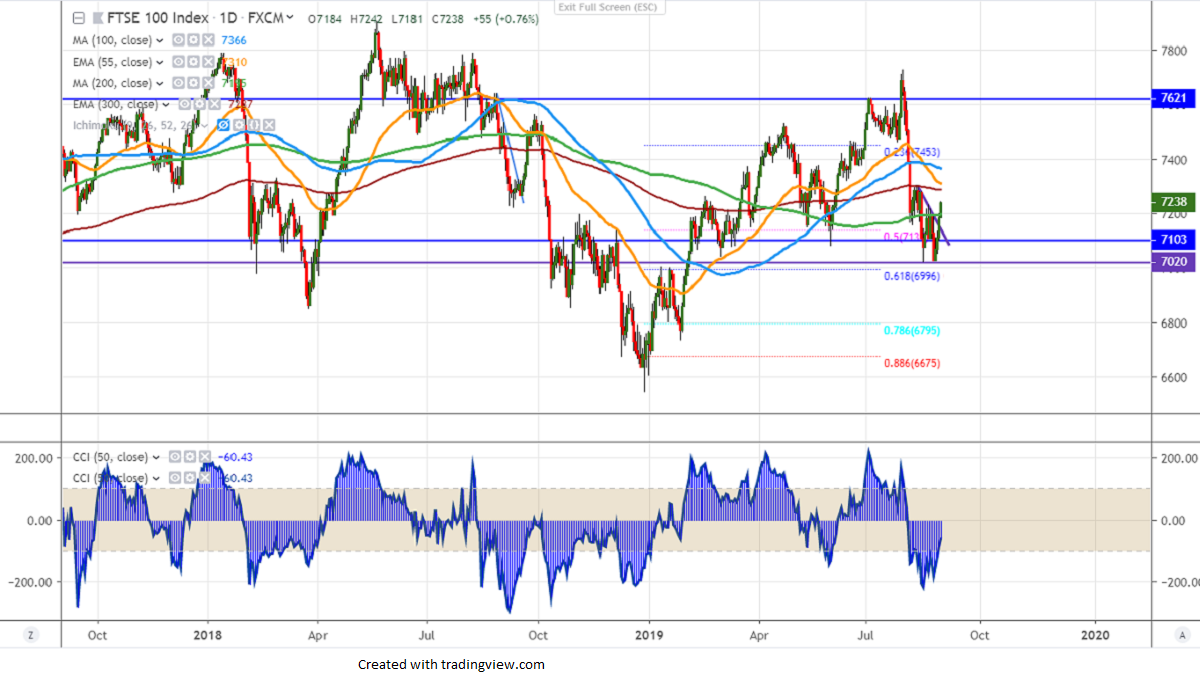

As per our analysis, FTSE100 is trading higher for 4th consecutive days and jumped more than 50 points for the day points following the footsteps of Wall Street. US markets especially S&P500 regained more than 3% in the past three days on easing US-China trade escalation. The index has formed a temporary bottom around 7020 and is currently trading around 7238. UK 10-year bond yield is trading lower and lost more than 35% in the last five trading days. The spread between UK 10 -year and 2- year got inverted once again by 5 basis points. The index hits high of 7242 at the time of writing and is currently trading around 7238.

The near term resistance is around 7250 and the index is trading well above 200- day MA, a jump till 7305 is possible. Any major reversal only above 7305.

On the flip side, the near term major support is around 7190 and any violation below will drag the index down till 7140/7100/7020. Any major decline only below 7000.

It is good to buy on dips around 7220-25 with SL around 7185 for the TP of 7305.