We find it premature to crown the dollar king and extrapolate continued broad USD strength into and through the second half of the year. Cyclical divergence, while still favoring the USD, is narrowing.

Also, this week showed the relative steepness of priced Fed hikes to be a vulnerability during global risk aversion, and the mature reduction of the dollar discount and short base suggests a higher hurdle for further bouts of dollar strength.

Next two weeks: A slew of political events, FOMC, ECB, BoJ, RBA, China economic data, EM trade and current account

Dear readers, before proceeding further into the core part of this article, we urge you to glance through below weblink where we advised 3 leg options strategy for hedging optimally.

Well, As USDJPY was well anticipated for price spikes, the pair has significantly risen from the lows of 104.629 levels to the recent highs of 110.036 levels amid the major downtrend, we’ve already advocated diagonal put ratio back spread about a fortnight ago.

For now, short leg (ITM shorts) of this strategy would have fetched attractive yields as the underlying spot FX has significantly spiked above, while long legs are yet to function having two months of expiry.

Bearish USDJPY scenarios are anticipated up to 100 if:

1) The global investors’ risk aversion heightens significantly,

2) Prime Minister Abe steps down and

3) Trump administration starts vehemently criticizing Japan’s trade surplus against the U.S.

Potential trigger events:

FOMC on Wednesday, BoJ meeting (June 15), End of Japan’s Diet session (June 20), Developments related to US trade policy, North Korea, and Abe scandals.

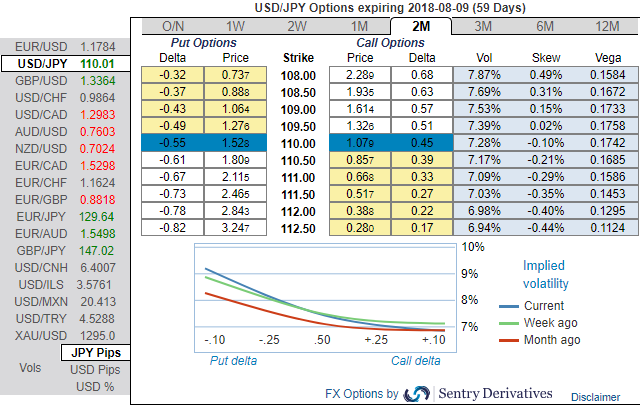

The positively skewed implied volatilities of 2m tenors signify the hedging sentiments for the further downside risks, this appears to be conducive for put option holders.

This bearish sentiment is substantiated by the mounting negative risk reversal (RRs) numbers, and negative RRs indicate the hedging sentiments for the bearish risks appears to be intact.

If you ponder upon cost effectiveness and wouldn’t like to divert exposure, we advocate upholding 2m USDJPY ATM put options (2 lots), (vanilla: 0.75%, spot ref: 110.022).

Skeptic investors can even deploy a 2:1 put back spread again by buying a number of puts at a higher strike and buying twice the number of puts at a lower strike.

The short leg with narrowed expiry likely to benefit time decay advantage which in turn reduces hedging cost on long leg of ATM put.

Currency Strength Index: FxWirePro's hourly JPY spot index has shown 3 (which is neutral), while hourly USD spot index was at 104 (bullish) while articulating at 09:59 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data