Since the Brexit referendum and the 2016 US election, the two major upsets during the turbulent 2016, FX option markets have been sensitive on the issue of political event risk premium. The upcoming 2020 US election pricing are gearing to be one of the most eventful in history and as one possible driver capable of breaking the fragile state that global economy lies in at the moment.

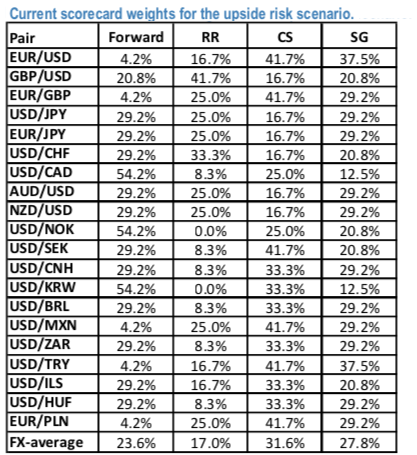

We referred to the JP Morgan’s newly introduced scorecard for selecting the best FX hedging instruments, for different currencies and over time. Skipping all technical details, the idea behind the model was just to highlight how different instruments could perform based on the relative interplay of different pricing parameters, allowing an optimal allocation as a function of time. The note has attracted the interest of several real money players, especially in the EUR-area, looking for viable solutions at a time when elevated (although slightly declining vs. Q4 2018) fwd points and flat yield curves implied heavy costs if implementing hedges via forwards.

We refer to the earlier piece for a more comprehensive review of the approach. The recent flip in the sign of the riskies cut the weight associated with riskies based on the rules of the scorecard. For GBPUSD risk-reversals get the highest allocation (41.7%) given the negative skew.

At present, the scorecard approach (refer above nutshell) favours call spreads (16.7% on average) and seagulls (20.8%) over forwards (20.8%) and risk-reversals (41.7%).

On GBPUSD upside, the JP Morgan’s scorecard approach has also largely outperformed the benchmark forward since 2014.

Forward points remain a factor impacting long forward positions, although less harmful than for EURUSD given the tighter carry.

Momentum has recently waned on GBP, with price remaining in a tight range over the past few weeks.

Sign of the skew well in negative territory favours “bullish” (i.e. long GBP calls and short GBP puts) risk- reversals over spread structures for playing GBP strength over medium horizons:

Sell 6m 25-delta risk-reversal (sell GBP put, buy GBP call) on GBPUSD at 1.3/1.6 vols indicative. Courtesy: JPM

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays