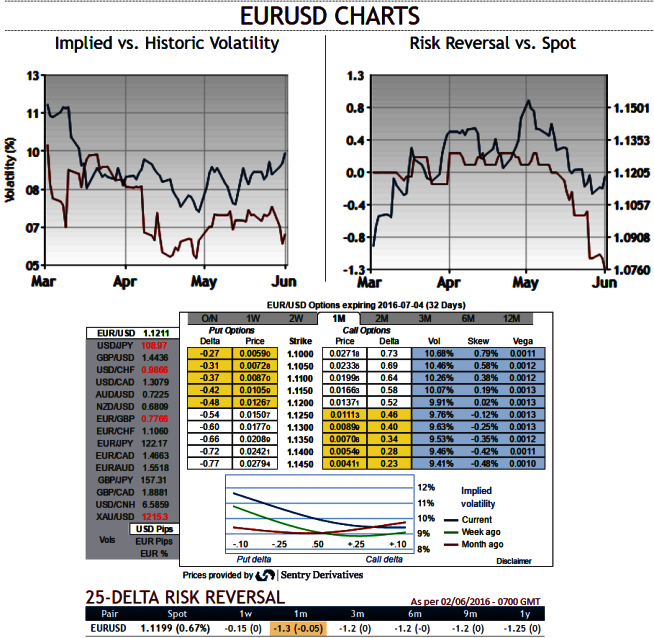

The implied volatility of ATM contracts for 1M tenors of this the pair is flashing at around 10%.

Delta risk reversals have been bearish neutral but with positive ticks creeping up gradually for next 1m expiries to signify the hedging positions are well equipped for downside risks over the longer period of time.

From almost last one year we've been seeing the pair oscillating within stiff sideway trend (ranging 1.1480 to 1.05 levels), so in that regard we see the divergence between underlying spot FX risk reversals from last week or so when EURUSD went into consolidation pattern.

Well, we perceives this as underlying spot likely to resume its bearish business to shrug off bearish neutral indications offered by OTC because we've never noticed any change in long term hedging sentiments.

If you consider long term euro's valuations then you would come across the convergence between spot curve and risk reversals (see spot/risk reversal relation in the diagram).

While current IVs of ATM contracts of euro crosses for 1W expiries acting crazily (EURUSD almost at 10%). 1M-3M expiries have been lingering around the same levels but favours bears in long run. And you can also observe at current juncture IVs acting dramatically with historical vols.

This disparity is majorly because bears lined as Euro retreaded below 1.0976 levels, many turned a sceptical eye to today’s crucial meeting of the ECB which is unlikely to change.

The 19-country central bank is expected to maintain status quo, with the corporate sector purchase programme and TLTRO II still to be launched, and higher headline inflation in the pipeline, the ECB will be in no hurry to launch any new measures.

Instead, ECB policy makers have increasingly focused on the need for other policy areas to pitch in.

The pair has rejected at important resistance at 1.1207 levels to slip below 7DMA curve. It is currently hanging at the same resistance levels with leading oscillators to converge the rallies but stiff resistance at 21DMA (i.e.1.1320).

Since, OTC market signals and technicals maximum upside potential upto 1.1320, any unexpected swings should only be viewed as shorting opportunities for formulating downside hedging strategies.

So, the strategy goes this way short 1W OTM striking puts, while double the size of longs in ATM and ITM strikes of 50% deltas and 3M tenors.

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data