When pondering about the ECB’s monetary policy meeting today, a proverb strikes our mind: if the mountain won’t come to Mohammed. This seems to be exactly ECB President Mario Draghi’s approach.

Despite weeks and weeks of speculation in the market that the ECB might soon change its communication and hike the deposit rate at the end of the year, developments that caused the euro to take off and caused some ECB officials to make cautious comments, Draghi has not commented at all since the ECB meeting in December.

He is (quietly) firm as a rock. But tomorrow we will hear his comments. The market will hang on his lips to find out whether the interest rate speculation is justified and what the ECB head’s view on the euro appreciation over the past weeks is.

We have been urging caution for some time in EURUSD, as the market’s view is exaggerated, and we see scope for a correction in the euro.

EUR was the best performing major last year (+13% vs USD, +8% on the NEER) as a substantial upswing in the business cycle intersected with a downshift in the political risk cycle. EUR became economically and politically investable and the resultant inflow of long-term investment capital lifted the surplus on the region’s basic balance to its strongest ever level (€500bn). This inflow allowed the currency to close the valuation gap that had been established as a consequence of ECB policy and political risk (the EUR REER was 9% cheaper than its 20Y average ahead of the French election).

We expect EUR to continue its rehabilitation this year. The region’s economy is expected to outpace the US for the third consecutive year notwithstanding US tax cuts; the ECB will end QE as a prelude to tightening in 2019; EUR bond yields should rise by more than in other DM countries as they are more overvalued; balance of payments trends should remain strong and counter a further deterioration in front-end rate differentials; and political risks should be laid to rest for the next 1-1/2 years if Italy elects a mainstream government as seems probable based on the trend in the opinion polls (we attach only a 5% probability to a non-mainstream government.

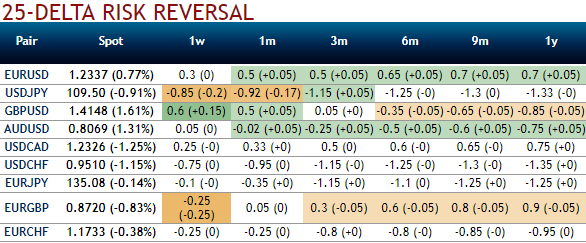

If you glance at OTC nutshell evidencing risk reversals, the above-stated euro strengthening is substantiated. Please be noted that the RRs of 1m-1y have been indicating the hedging sentiments of bullish risks, while 3m IV skews are also justifying the same stance.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics