As long as the SNB does not provide any signals that it considers exiting its expansive monetary policy, the euro will continue to point the way ahead.

We expect the euro to tend to lose ground against the Swiss franc in the coming months, as the weaker economic outlook for the eurozone and thus the ECB's less scope for action has not yet been adequately reflected in the EUR exchange rate. The ECB will not raise interest rates in the first half of next year, but will probably only become active late in 2019.

However, the SNB's continued expansionary monetary policy relative to the ECB should keep EUR-CHF from falling significantly below 1.14-1.15.

Meanwhile, we consider the risk of a stronger euro due to political reasons to be low. The market has already sufficiently priced in the prospect of a more integrated eurozone.

Moreover, there are no signs that Macron's European plans will be implemented quickly. Once it is foreseeable that the ECB will, in fact, raise interest rates for the first time, EURCHF should rise again, probably in the course of 2019 but in the near-term we expect the underlying pair to remain in the tight range although it manages to hit the new highs.

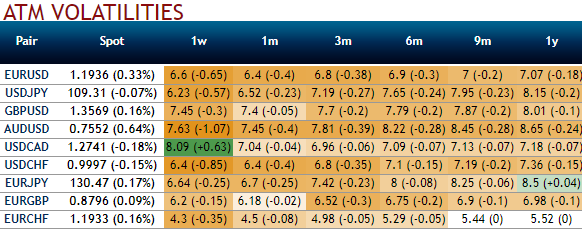

Most importantly, please be noted that the options writers are on upper hand, if you glance at the above nutshell evidencing IVs, EURCHF has been the pair to show the least IVs, while positively skewed IVs of 1m tenors are well balanced and risk is skewed on either side. So, both OTM puts as well as OTM calls will have equal opportunity for expiring in the money.

Lower IVs to offer advantages for options writing that are exorbitantly priced-in. So, never miss out the opportunity in such instruments.

Hence, we advocate shorting EURCHF 1.1515 - 1.2015 strangles of 1m tenors against shorting EURCHF in the spot, the trade is desirable and suitable contemplating low implied volatilities.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 97 (which is bullish), while hourly CHF spot index was at 57 (bullish) while articulating (at 12:42 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom