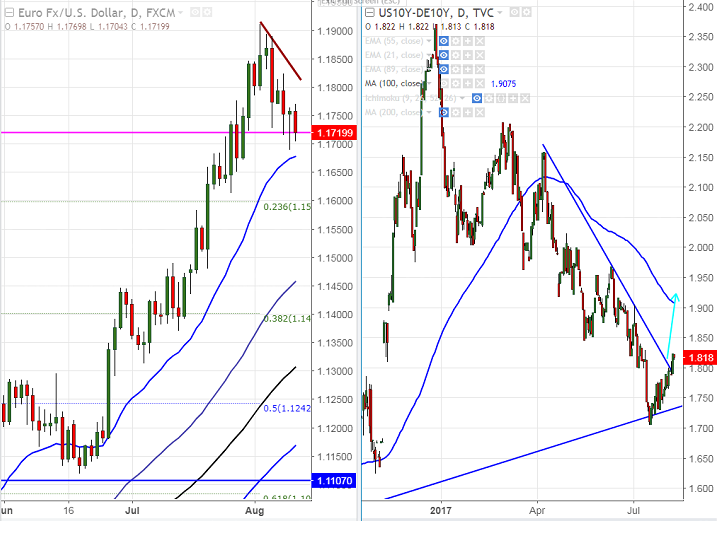

- EURUSD has formed a temporary top around 1.19097 and declining sharply from that level. The pair declined till 1.16885 yesterday. It is currently trading around 1.7202.

- Market awaits US PPI and CPI data to be released this week for further direction. The yiled spread between US 10 year and German bund is widening and this confirms minor top has been formed by Euro and slight decline is possible.

- On the lower side, 1.16500 will be acting as minor support and any break below will drag the pair down till 1.15980 (23.6% retracement of 1.05694 and 1.19098)/1.1500.

- EURUSD shown a minor jump above 1.1800 on Tuesday and started to trade below that level. Short term trend is still weak as long as resistance 1.18250 holds. Overall bullish continuation can be seen above 1.1910. The near term resistance is around 1.1770 and break above targets 1.1800/1.18250.

It is good to sell on rallies around 1.17250-1.17300 with SL around 1.1800 for the TP of 1.1600/1.15250.