We suggest that offsetting forces and a period of relatively calm central bank activity will push FX volatility down in H2. Major central banks such as BoJ, RBA, RBNZ and the ECB face strong internal resistance to deeper rate cuts, and on Fed and BoE are on the other corner whose policy actions have been deferred on account of the global slowdown and Brexit pressures respectively, not least from banks and insurance companies.

On its side, the Fed will not want to upset the apple cart. FX volatility, of course, is unlikely to fall before the UK referendum, and if the UK decides to stay in the EU, we will recommend selling FX volatility.

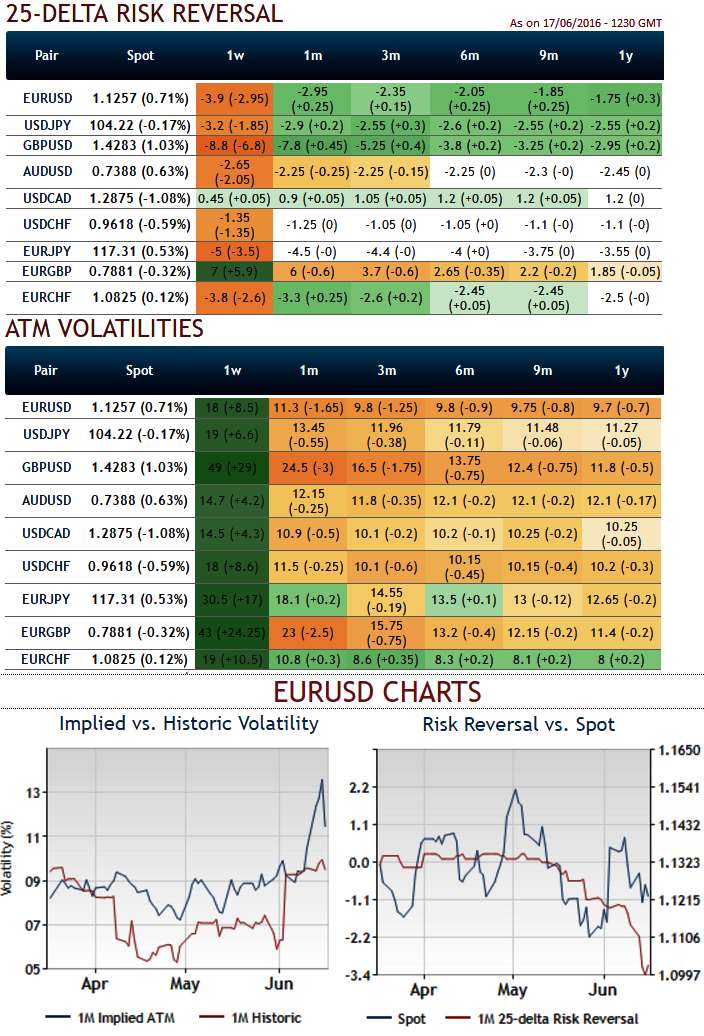

Realized volatility is likely to continue falling and implied should follow. We, therefore, recommend buying a 6m EUR/USD double no-touch option with barriers delimiting the range. This option is short vega, and with the spot not being in the middle of the range but close to one of the knock-out barriers, it currently offers significant leverage.

As central bank activism should begin with slowness in H2, EUR/USD is unlikely to break its range and volatility is set to shrink away as shown in IV nutshell.

Trade recommendation1: Shorting FX implied vol during early stages of H2 using OTM options of USDJPY and EURUSD is a smart approach that would likely perform in an environment of falling volatility as suggested in our previous write up on the negative risk reversals.

Likewise, in our trade recommendation 2, AUD/USD barrier option is short vega, as we expect the spot to fall gradually rather than collapse.

Buy EUR/USD 6m double no touch, knock-out 1.09-1.16, indicative offer: 10-15% (spot ref: 1.13)

Risks: Limited to the premium. Investors buying a double no-touch option cannot lose more than the premium initially invested. However, it will be knocked out if EUR/USD hits 1.09 or 1.16 at any time before the 6m expiry.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.