EURUSD prices are back under pressure, having failed to break-out stiff resistance at around 1.1466 - 1.1518 areas. We are now developing into a bear channel, with 1.1385 resistance and 1.1280/70 the next support - that ahead of the 1.1215 recent lows.

On medium-term perspective, we view 1.12 - 1.08 as a major support region and the ideal area for a long-term higher low over the 1.0340 lows set in 2016. Notable supports within this region lie at 1.1190 and 1.1000. We need further evidence that 1.1215 was the higher low we are looking for.

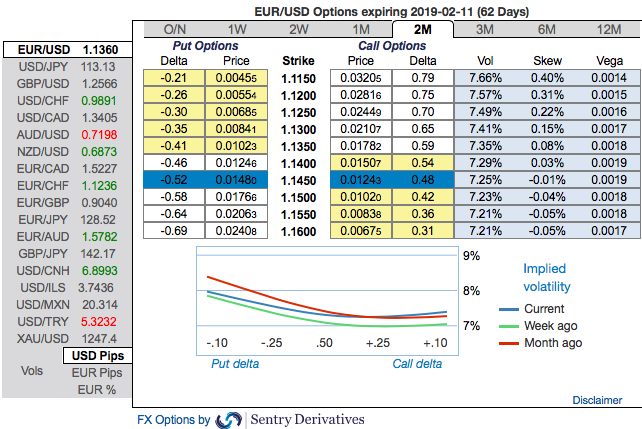

OTC Outlook: Please be noted that the positively skewed IVs of EURUSD of 2m tenors signify the hedging interest of bearish risks.To substantiate this stance, the negative risk reversals across all tenors also indicates bearish risks remain intact in the major trend, while positive bids in the short-run indicates mild upside risks.

Well, contemplating above-stated driving forces and OTC indications, options strips strategy is advocated on both trading as well as hedging grounds. The options strips strategy which contains 3 legs needs to be maintained with a view to arresting price downside risks.

It’s a quiet calendar week for data releases. Most market interest will probably be on the ECB’s and SNB’s monetary policies are scheduled for this Thursday, while German & French PMIs and US retail sales numbers on this Friday Principal interest, however, will be reserved for ECB.

The US dollar index is up 0.6% on the day. EUR fell from 1.1440 to 1.1355. The US 10yr treasury yield ranged sideways around levels last seen in August, between 2.82% and 2.86%. The 2yr yield touched 2.68% - a three-month low. Fed funds rate futures continued to price the chance of a rate hike on 19 December at 70%. Beyond that, a March rate hike is only given a 20% chance.

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Considering the bullish (in near-term) and bearish technical environment (in long-term) and most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish risk reversal numbers.

The execution: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 2M tenors, go long 1m at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside.

Currency Strength Index: FxWirePro's hourly EUR spot index is showing 27 (which is bullish), while USD is flashing at 114 (which is bullish), while articulating at (07:19 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices