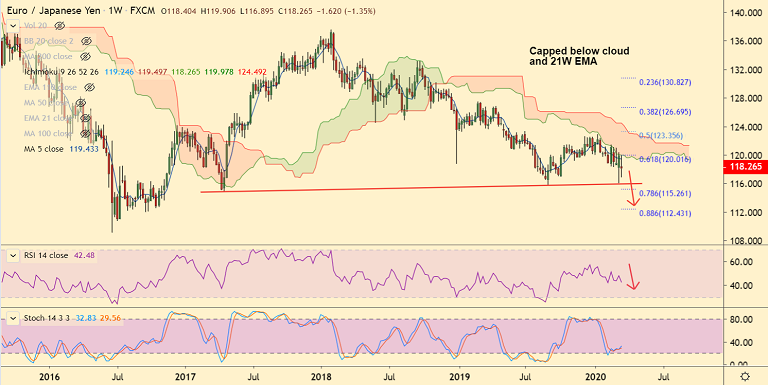

EUR/JPY chart - Trading View

EUR/JPY is extending range trade below 21-EMA, near-term outlook remains bearish.

The pair was trading 0.23% lower on the day at 118.07 at 10:38 GMT, after closing 0.33% higher in the previous session.

Euro dampened after the ECB announced a €750 billion QE programme late on Wednesday, expected to run at least until year-end.

Poor data which showed preliminary German IFO Business Climate dropped to 87.7 for the month of March, the lowest level since August 2009 added to the downside pressure.

Also, data released earlier today showed Eurozone Current Account surplus widened to €34.7 billion during January.

Price action has failed to break above 200-DMA. Major and minor trend for the pair are bearish.

Weekly cloud and 21W EMA offer stiff resistance on the upside. Momentum is bearish and RSI is below 50.

Resumption of downside likely. Next bear target lies at 116 (trendline) ahead of 78.6% Fib at 115.26.

Support levels - 116 (trendline), 115.26 (78.6% Fib)

Resistance levels - 118.87 (21-EMA), 120.05 (200-DMA)

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge