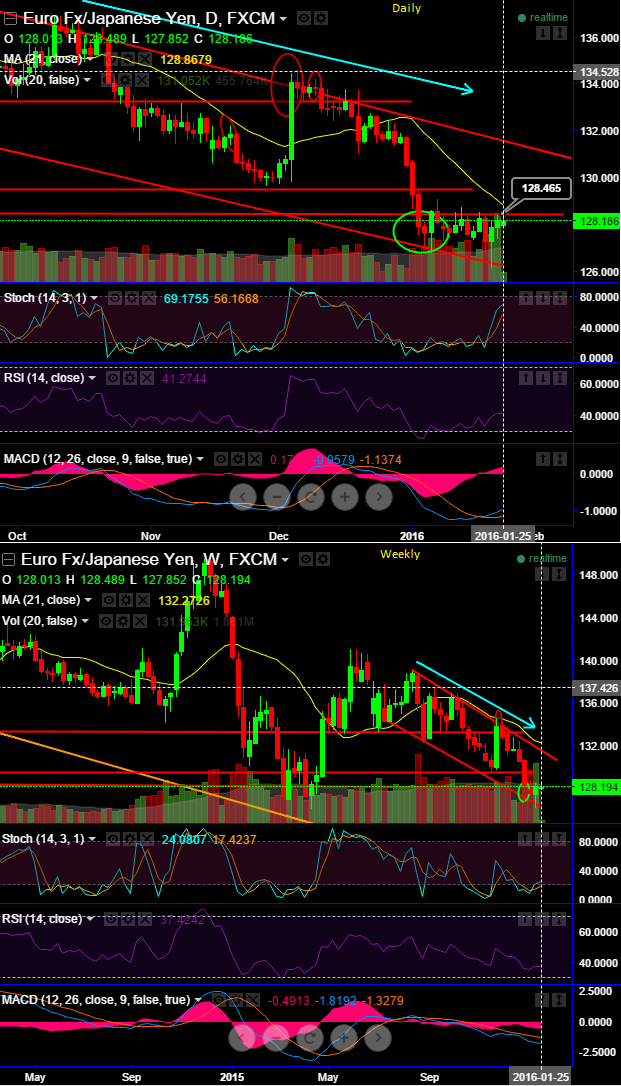

Although, both on daily and weekly price patterns of the pair tested supports at channel base line at around 126.416 (last week's lows) to form a bottom but on again weakness is seen in this pair when it has rejected resistance at 128.489 levels (today's highs).

While leading oscillating indicators in intraday charts have begun diverging with price rallies in prevailing downtrend which would mean that the short bulls losing strength at the valuations of 128.489 levels where too much supply has experienced in recent past also (see resistance at the same juncture).

More interestingly, RSI on daily terms has been directly proportionate with price behaviour. Currently, weekly RSI trending near 40.7383 levels (while articulating) with upward convergence to the dipping prices.

The slow stochastic noises with bullish cross above 60s on daily charts (current %D line flashes at 64.5570). So, is it breaches the existing resistance at 128.489 would bring in more bullish speculation for next resistance at 129.490 levels.

Retrospectively, preceding bearish trend in medium term signifies shorting chances as it has slipped well below 21DMA on all time frames.

Most convincingly, volumes build ups have been mammoth along with price jumps confirms short term rallies can also not be disregarded.

Hence, keeping 128.489 in mind short term traders can speculate this pair upwards, but there is a clear sign of bulls creating selling opportunities for long term bears as a result of overbought pressures So overall, EUR/JPY is steaming up with heaps of bearish indications by leading oscillators in addition.

Contemplating certain bearish swings and abrupt brief upswings also, we recommend buying any calendar spread that takes care of certain yields regardless of swings.

FxWirePro: EUR/JPY attempts of breaching resistance at 128.489 creates bullish speculation but long term bear trend is intact

Monday, January 25, 2016 8:35 AM UTC

Editor's Picks

- Market Data

Most Popular

2