Following the ECB’s surprisingly dovish message in the recent past, signalling no hikes in 2019, we see significantly less upside for EURJPY in the short-run, EURJPY could probably show slumps further in the major trend this year amid the minor upswings in the short-term, a possibility of this cross falling towards 122 levels.

On the flips side, the Bank of Japan (BoJ) maintains negative rates, slow normalization of monetary policy is ruled out, as inflation in Japan has so far made no attempt to approach the BoJ's 2% inflation target. The BoJ is no longer expected to raise the yield target in 2020 given the downgraded inflation outlook. Hence, we could foresee EURJPY at 122 levels on a 3M horizon.

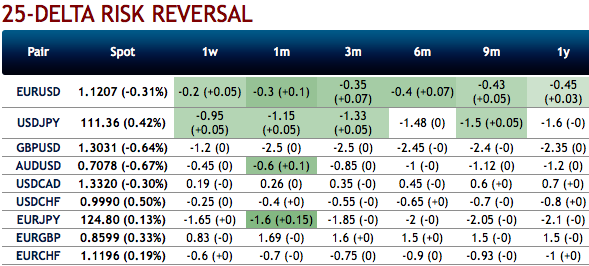

OTC FX Updates: The hedging sentiments of this pair are in line with the above projections.

Risk Reversals Substantiate Skews (EURJPY): We could see the addition of fresh positive numbers (in 1m tenor) to the existing bearish risk reversal set-up of euro crosses (especially EURJPY and EURUSD) that indicates minor upswings.

While the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m IVs are overall OTC barometer is a noteworthy size in the forex options market that can stimulate the underlying forex spot rate.

Hedging skewness (EURJPY): Most importantly, to substantiate the above indications, please be noted that the positively skewed IVs of 3m tenors that are also signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors expect that the underlying spot FX likely to break below 121.00 levels so that OTM instruments would expire in-the-money.

Options Trade Recommendation (EURJPY): EURJPY has been bouncing from the lows of 123.652 levels to the current 125.345 levels in the interim trend, while the major downtrend remains intact.

Technically, the pair forms hammer and dragonfly doji pattern candles at 124.133 and 124.275 levels respectively on daily terms, and hammer at 124.601 level on monthly terms.

The formations of above-stated bullish patterns evidence the upswings on both timeframes amid the major downtrend. For now, more rallies are possible only on a decisive break-out above 21-DMA and the stiff resistance of 125.995 levels, strong support is seen at 123.648 levels. The bullish momentum confirmed by leading oscillators but trend indicators decisive.

Contemplating the above factors (especially the prevailing upswings), we advocate buying 3m EURJPY (1%) ITM -0.69 delta puts for aggressive bears on hedging grounds. If expiry is not near, delta movement wouldn’t be 1-point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money put option with a very strong delta will move in tandem with the underlying.

The main driving forces of bearish EURJPY are as the following:

1) The eurozone growth is all set to stay weak for most of H1’2019 and the ECB is clearly keeping an eye on this risk; Euro growth gets stuck below 2% and ECB hikes only in 2020;

2) The extended political protests in France, a populist tide at the European parliamentary elections in May. Source: Sentrix and Saxobank

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 64 levels (which is bullish), while hourly JPY spot index was at -127 (highly bearish) while articulating at (08:27 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook