The above table ranks in shrinking implied volatility among euro currency crosses, euro spiking due to the ECB failed in forward guidance after announcing interest rate to be reduced at 0.0% from 0.05% and deposit rate at -0.4%.

Thereby, for at least the next 2 to 3 months, you cannot expect any policy action from the central bank whenever is needed. This would lead us that the market was short euros after the rate decision, its shift to a quasi-neutral monetary policy stance after easing triggered a wave of short covering.

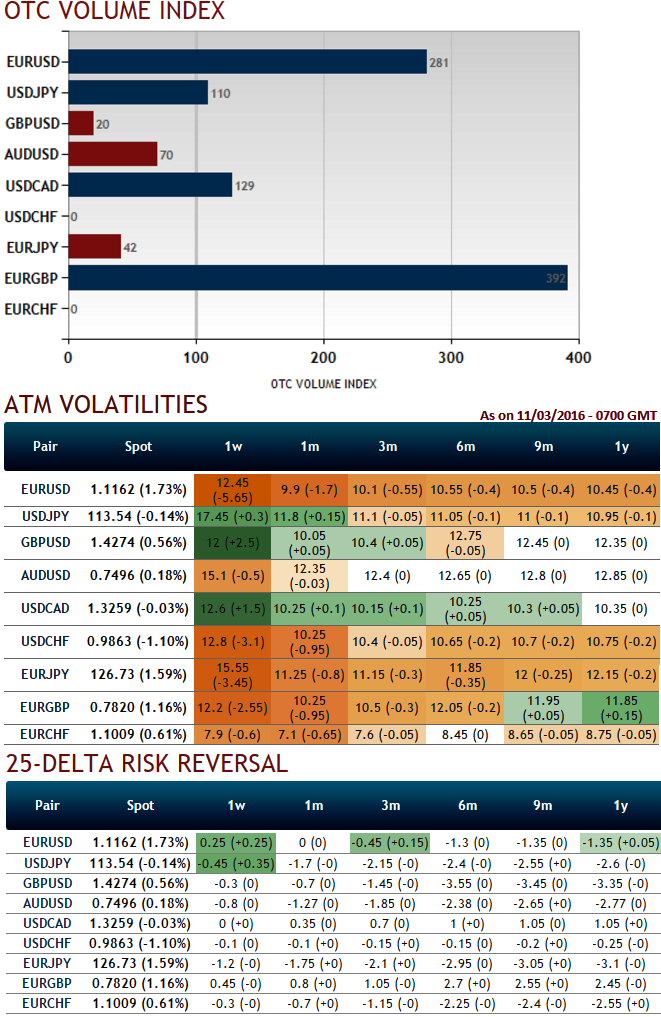

Thus, IVs and risk reversal readings of EURUSD and EURGBP have been drastically reducing for 1W expiries, remain stabilized for 1m-1y tenors, but OTC volumes pumping up (refer diagram for OTC VIX), so these IVs are still the best buys on the respite from sellers.

Hedging upside risk of EURGBP:

The delta risk reversals favour both short term and long term bulls as this pair is flashing up progressively with positive numbers that signify hedging arrangements for upside risks over the period of time.

With the adjustment to the IVs, risk reversals and next significant event that can have the major impact on EURGBP would be UK referendum (that is scheduled 2 months from now), BoE's bank rate is likely to be on hold in next week's monetary policy, IVs of EURGBP for 1W expiry is still over 12% likely to reduce but not below 10% which is conducive for call option holders contemplating risk reversals.

Hence, considering OTC market reasoning we think upside risks are intensifying, as result we continue to stay firm deploying ATM instruments in hedging strategies are worthwhile. So, we decide to initiate a bull option combinations at net credits capitalizing on IVs, RR and ATM calls.

So, buy 6M at the money calls with 50% delta, simultaneously, short 1M (-1%) in of the money put with positive theta.

When IVs flashing higher and going along with OTC sentiments, the likelihood of strategy's positive cash flows is very high.

FxWirePro: EUR/GBP hedging volumes mounting after ECB - debit combos for upside risks

Friday, March 11, 2016 11:47 AM UTC

Editor's Picks

- Market Data

Most Popular