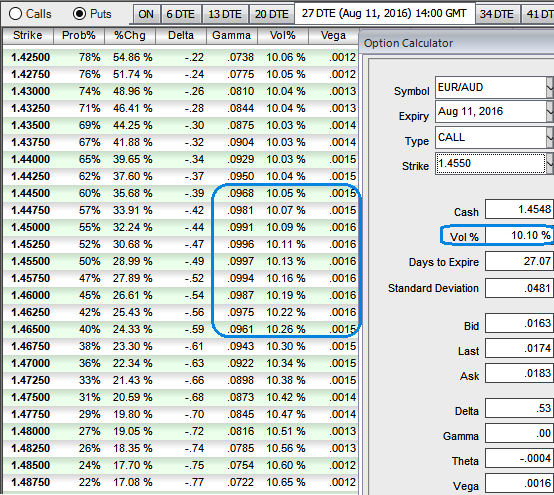

The above diagram demonstrates the equal probabilities of gamma effects when you move towards on either direction of OTM or ITM strikes.

These gamma values measure the rate of change of the delta with respect to the movement of the rate in the underlying market. In the sensitivity table, gamma shows how much the delta will change if the underlying rate moves by 1%.

While volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

The current spot FX reference at 1.4548, even if you shift either sides (upper strikes or lower strikes, volatility smiles seem to be stable.

But considering the prevailing major bear trend of this pair and sensitivity analysis, unlike a simple naked put, option strips have an extra-long on put side and also with the upside protection as well. The leveraging effects is also an added advantage favouring the major trend.

So, the recommendation, for now, is to go long in 2 lots of 2M At-The-Money Vega puts that would function effectively in higher IV times. And on the other hands, go long in 1 lot of 1M at the money call option.

The strategy is likely to generate assured returns regardless of swings on any directions, even if it drifts sideways the premiums will wipe off on time decay and the maximum cost of trade would be to the extent of initial premiums you’ve paid.

EURAUD ATM options would be far more sensitive since higher IV greatly increases their chances of expiring ITM which is why we prefer ATM strikes to adding more weights in the longs of this strategy.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data