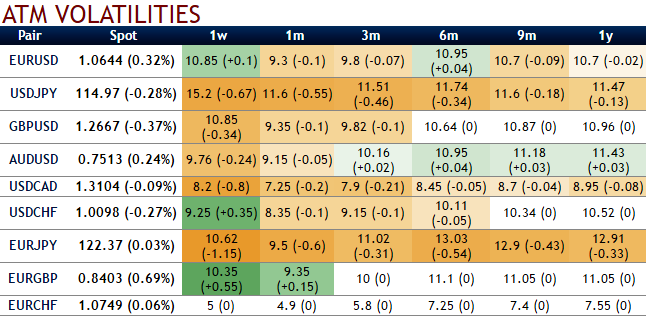

Euro IV and RV curves are diverging, while risk reversals and underlying spot curves are converged, Fed has delivered with rate hikes as anticipated, ECB shifted its policy and EURUSD breaks its long lasting range bounded trend to hit fresh 13 years lows at 1.0415 levels.

Amid all these developments, we reckon longer-tenor EUR implied vols, especially expiries spanning the Dutch and French elections should, however, prove to be a more reliable, persistent store of event risk premium and relatively immune to tactical gamma developments, hence 1Y EUR vol remains one of our core vega longs for next year.

Aside from a smaller theta bill, owning 9M-1Y tenors also has the benefit of flat/ marginally positive slide along the vol curve that mitigates cost-of-carry. The net result of sturdy back-end vs. softer front-end vols is that the vol curve is likely is likely to steepen further, which can be exploited via calendar spread structures.

The preference for owning EUR vega never extended to risk reversals, however, and the possibility of truncated EUR weakness signaled by this week’s ECB policy shift increases our conviction that deep OTM EUR puts will continue to underperform, and that they are better sold by directional EUR bears in put spread/digital structures.

One feature of the EUR-vol surface that potentially offers an alpha generating opportunity while positioning for an eventual turn higher in the spot is the shape of the EUR call term structure.

Despite an election related-bump around the 6M maturity bucket, the 25D EUR call curve is on the whole much lower and flatter than the ATM or 25D EUR put curve, hence investors who agree with the down-in-H1-up-in-H2 profile of our EURUSD 2017 forecast should find value in positioning short 3M vs. long 9M or 1Y OTM EUR call calendar spreads (not delta-hedged).

The track record of such structures in delivering high Sharpe Ratio returns since the QE-led Euro decline ran its course last year is eye-catching, and they only place the net upfront premium at risk should outsized spot moves materialize in either direction contrary to baseline expectations.

Besides reflecting a temporal view on spot trajectory and exploiting the flatness of the EUR call curve, the principal appeal of such calendars is their ability to earn positive time decay, and hence are useful diversifiers for portfolios currently leaning long dollars and running up negative carry/decay bills.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields