ECB’s Mario Draghi’s press conference yesterday did not help the euro. European central bank’s President modestly seemed too pessimistic for that: growth and inflation forecasts revised down, warnings of global risks. On the other hand, he could have sounded even more dovish. New long-term tenders do not seem to be an immediate issue. The ECB’s rhetoric was sufficient to ensure that the official announcement of QE measures ending was not seen as a hawkish signal by anyone. With such a skilful communicator at its helm the ECB does not need to take any strong material actions to achieve what it wants. Although yesterday’s press conference did not constitute a negative signal for the EUR exchange rates in the long run, some pressures could be foreseen.

On a broader perspective, we view EURUSD at 1.12-1.08 as a major support region and the ideal area for a long-term higher low over the 1.0340 lows set in 2016. Notable supports within this region lie at 1.1190 and 1.1000.

FX Derivatives Strategy: Options Strips

Combination ratio: (2:1)

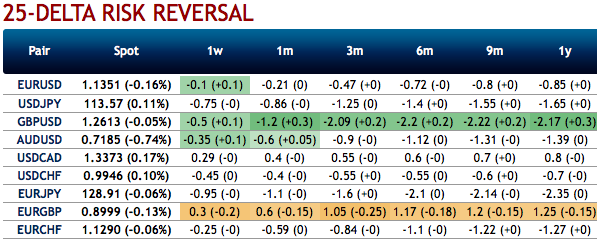

Rationale: EURUSD skews have been well-balanced on either side that signifies hedgers interest in both OTM put and OTM call options.

Contemplating above fundamental factors and the RRs for positive bids in the near-term and bearish technical environment (in long-term) and most importantly, the positively skewed IVs in the sensitivity tool coupled with bearish risk reversal numbers indicate more biased towards downside risks.

The execution: Initiate long in 2 lots of EURUSD at the money -0.49 delta put options of 2M tenors, go long 1m at the money +0.51 delta call option simultaneously.

The strategy can be executed at net debit with a view to arresting FX risks on both sides and likely to derive exponential returns but with more potential on the downside.

Alternatively, shorting futures of mid-month tenors are advocated with a view of arresting further potential slumps. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -63 levels (which is bearish), while hourly USD spot index was at 79 (bullish) while articulating (at 11:54 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated