Ahead of BoE’s monetary policy that is scheduled tomorrow, GBP has been drifting modestly lower on delayed rate hikes until much later in 2018 as core CPI continues to moderate and wages remain sticky below 3%, so lacking the drama that has pertained to the euro during the last few weeks or indeed to GBP itself during April when the market was forced to mark down its views on BoE policy as it became clear that the economy had ground to a virtual halt in 1Q.

Cable prices remain under pressure into this afternoon’s key vote. While under 1.3230-1.3290 resistance, risks remain for a move towards 1.3110 next support. Below there 1.3020-1.2935 is the next support region. EURGBP Prices are back towards the top of the current 0.8680 to 0.8840 range as we head into this afternoon’s HoC vote. Intra-day momentum remains up, so a move closer to the range highs is possible. While EURUSD is biased for a new low to be set under 1.1510, and so is GBPJPY, mounting bearish pressures.

The two chambers of the British Parliament continue to argue with the government over the Brexit legislation. Today the House of Commons will vote on an amendment brought forward by the Upper House on Monday that is to give Parliament a “meaningful vote” should Great Britain be at risk of leaving the EU without a deal. If the House of Commons accepts the amendment, the risk of such a hard Brexit would fall considerably, which would be GBP positive.

On the other hand, it is unclear what effects the defeat would have on the stability of the government and the Brexit negotiations. Ahead of tomorrow’s Bank of England rate decision focus is therefore once again on the Brexit risks for the GBP outlook.

But even this relative stability in GBP is noteworthy insofar as GBP has conspicuously failed to generate the kind of safe-haven inflows as a result of the Italian crisis that was commonplace for large parts of the multi-year sovereign crisis in the Euro area. The resultant collapse in the beta between EURGBP and EURUSD to close to multi-decade lows (chart 1) demonstrates that a re-emergence of political stress in the Euro area isn’t sufficient to free GBP from the burden of Brexit, certainly not as far as cable is concerned.

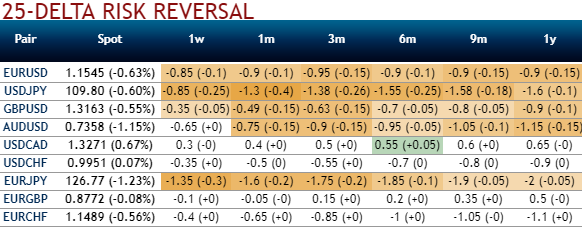

From the above nutshell, one can observe the increase in negative risk reversal numbers of GBP pairs that signify the hedging sentiments for the bearish risks. Accordingly, FX options transactions are entered into as a hedge against an unfavorable probable future event. Foreign exchange options (also known as FX, forex or currency options) are contracts where the buyer has the right, but not the obligation, to exchange currency on a certain future date at the exchange rate and in the amount fixed at the time of entering into the transaction.

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing -61 (which is bearish ahead of HoC votes on Brexit) while articulating (at 10:49 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence