Fed Chair Powell earlier this week said policymakers are ‘closely monitoring’ risks to the US economy, in particular, how persistent any effects might be. For the time being, there appears no inclination to change policy interest rates. The potential economic impact of coronavirus remains the key focal point for financial markets, with the number of cases, jumping higher.

Meanwhile, at the House of Lords, BoE Governor Carney on Tuesday said that past experience of pandemics showed that much of output lost could be recovered later.

However, he warned that in the absence of a post-election bounce in activity, the BoE may yet add more stimulus.

As the United Kingdom has left the EU and now the horse trading is likely about a trade agreement, which will determine future relations, is going to start properly. We continue to foresee downside risks for Sterling.

OTC updates: GBP will likely take its directional cue from the read-through to Brexit whereas the size of the move will be augmented or moderated by the government’s broader policy platform, this is factored-in GBP’s FX options market.

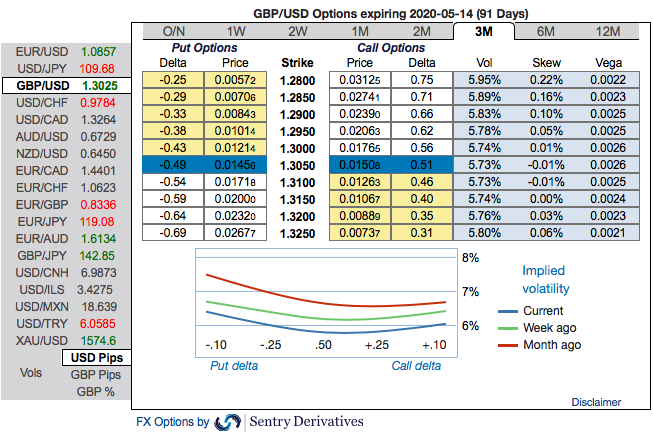

Please observe 3m GBP skews that has stretched on both the sides, hedgers have shown interests on both OTM Calls and OTM Put options.

To substantiate the downside risk sentiment, risk reversal numbers have still been signalling bearish hedging sentiments in the long run amid minor bids for upside risks. Hence, we advocate the diagonal options strategy on both hedging and trading grounds.

Strategy (Debit Put Spread): Capitalizing on the above factors, it is prudent to deploy diagonal options strategy by adding short sterling via a limited loss tail hedge: Stay short a 1M/3W GBPUSD put spread (1.33/1.29), spot reference: 1.3038 level. Courtesy: Sentry, JPM & Commerzbank

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data