We remain long Latam FX but mixed February performance makes us consider hedges. The Fed’s dovish tone and warming of China-US relations make us believe that a buy-on-dips strategy remains appropriate for now. FX valuations have become more concerning, and some optimism regarding reflationary dynamics (as shown by the disappointing China manufacturing PMI print) make us, on the other hand, prefer to maintain some defensive hedges as well.

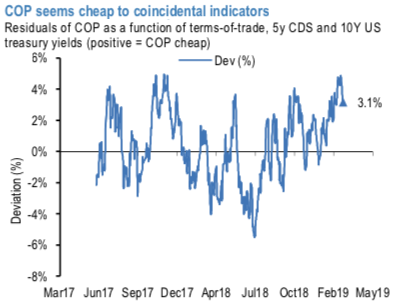

Stay long though despite some risks surfacing. The large rally in international oil prices YTD should continue to buoy COP, and we maintain that – despite COP’s strong performance - our valuation models continue to screen it as cheap. More specifically, normalized residuals of COP as a function of terms-of-trade, 10-year treasury yields, and the 5-year CDS, are showing the peso as 2.8% cheap (1.2 sigma, refer above chart).

Hence, we maintain our overall long Latam FX position in JPM’s GBI-EM portfolio (via BRL, COP and PEN) and our outright trades on hedging grounds: short USDARS 12m NDF (+3.0%), ahead of Brazil’s current account and FDI flow and Mexican retail sales data announcements we advise long BRLMXN (-3.2%), Buy 6M 25D BRL calls/JPY puts vs USD puts/BRL calls, equal vega.

Long USDCLP (+0.3%) and MXN puts with KO = 18.5. Buy 1M USDMXN vs. short USDBRL ATM, equal vega. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is at 21 (mildly bullish), EUR is at -100 (bearish) and JPY is flashing at 111 (bullish) while articulating (at 12:45 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential